Definitive Guide to Industrial Commercial Real Estate Investing

From manufacturing to shipping, distribution and beyond, industrial real estate has long been a core driver behind many firms’ investment strategies. Fueled by the rising demand for e-commerce fulfillment channels, the recent shift in focus from retail to industrial brought an even brighter spotlight on this property class. While the spotlight on industrial has waned, […]

Back to Basics: Multifamily Real Estate Fundamentals (2024)

Not all commercial real estate is created equal: This is the first blog post in a series about fundamentals across major CRE property type sectors. The old adage rings true as much today as it did during the 2007/2008 Great Financial Crisis: real estate is a cyclical market. Despite short-term tailwinds, strong real estate fundamentals […]

Optimize the Homebuilding Lifecycle in One Source of Truth

For homebuilders, managing the complexities of building new homes is challenging due to data silos, regulations and regional or localized strategies. Selecting, building and delivering a profitable community in the competitive homebuilder market requires a thoughtful strategy, meticulous planning and calculated execution. Deal management software has unlocked a vital competitive advantage for homebuilders in today’s […]

25 Commercial Real Estate & Technology Trends to Know in 2024

This blog post was last updated on April 17, 2024 with new information about the latest commercial real estate trends. Evolving conditions have forced investment managers to keep a close eye on global, regional and local trends. Falling valuations, high costs of capital and global volatility have left a lasting impact on the commercial real […]

What is Loan to Value Ratio ? [LTV Formula & Definition]

The loan to value ratio is a measurement of an investment’s risk found by dividing the loan amount by the appraised value. In this blog post, we’ll break down what the loan to value ratio is, how to calculate it, why it matters for CRE lenders, and what makes a good LTV. What Is the […]

Night of the Living Data: 5 Dead Deal Report Insights

There’s nothing spookier for CRE investment professionals than dusting the cobwebs off of an old spreadsheet or email to find dirty data, or that it simply disappeared into darkness. Rapid, granular data insights are now table stakes in the highly competitive CRE industry. Beyond real-time analytics and reporting, however, one largely untapped channel to fuel […]

How to Find Commercial Real Estate Cap Rates (Formula)

This blog post was last updated on October 11th, 2023. One lens through which investment managers evaluate a new deal is calculating its commercial real estate cap rate. The commercial real estate cap rate of a property offers a glimpse into the risk and return. This helps investors to understand the deal’s risk profile compared […]

How to Build a Commercial Real Estate Comps Database With OMs [Guide]

This blog post was last updated on Wednesday, September 13th. Investor intuition and market knowledge are invaluable as your firm evaluates deals, but data must be the bedrock of multi-million dollar investment decisions. Every real estate offering memorandum (OM) you review can add value to your investment decision-making–and more broadly, your institutional data advantage– in […]

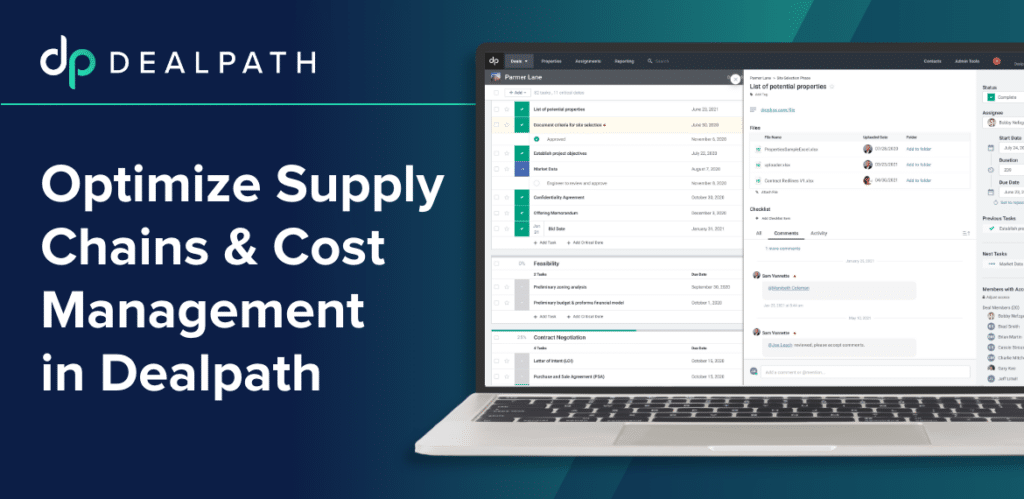

3 Tips to Conquer CRE Development Supply Chain Challenges in Dealpath

Commercial property insurance costs have increased by 10% year-over-year, while experts anticipate high borrowing costs could cause a construction slowdown, even as the Fed continues rate hikes. All the while, developers continue to navigate real estate supply chain bottlenecks and rampant inflation, stalling project deliveries and profitability. While these challenges are here to stay, there […]

The Definitive Real Estate Due Diligence Checklist (And How to Digitize It)

This blog post was last updated on Wednesday, July 5th. Before finalizing a new acquisition, development, disposition or lending deal, investors thoroughly vet the deal during due diligence to ensure it aligns with their ideal risk-return profile and identify red flags. Exhaustively investigating the property, financials, zoning, and nearly all other investment criteria creates much-needed […]