Amass market intelligence and mitigate risk while gaining visibility into all debt origination activities across different originators, regions and teams

Why Debt Origination EXECUTIVES CHOOSE Dealpath

Dealpath simplifies debt management for institutional investment teams by providing a centralized platform with all necessary tools for efficient and risk-adjusted debt origination.

Aaron Tink

Portfolio Manager

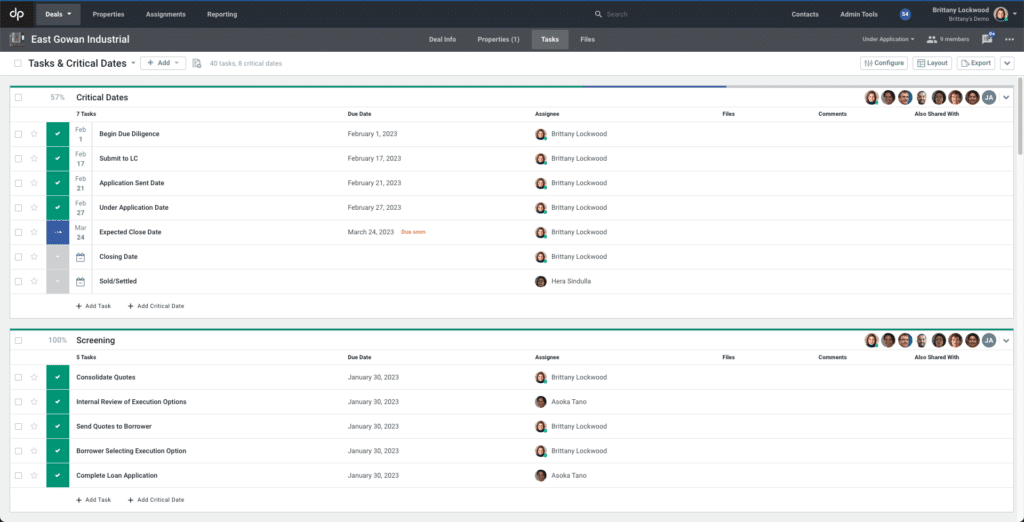

Dealpath is the database T2 needed to track deals we’re looking at, deals we own, and all of the files, communications, and other details related to them. It’s not just a checklist manager, a calendar, or a report builder — it’s all of those things. That Dealpath can accomplish all of that, while simultaneously tracking interest rates on loans, notes from borrowers, and building reports is what makes it the right tool for us.

More deals evaluated

Increase in deals closed

More capital deployed

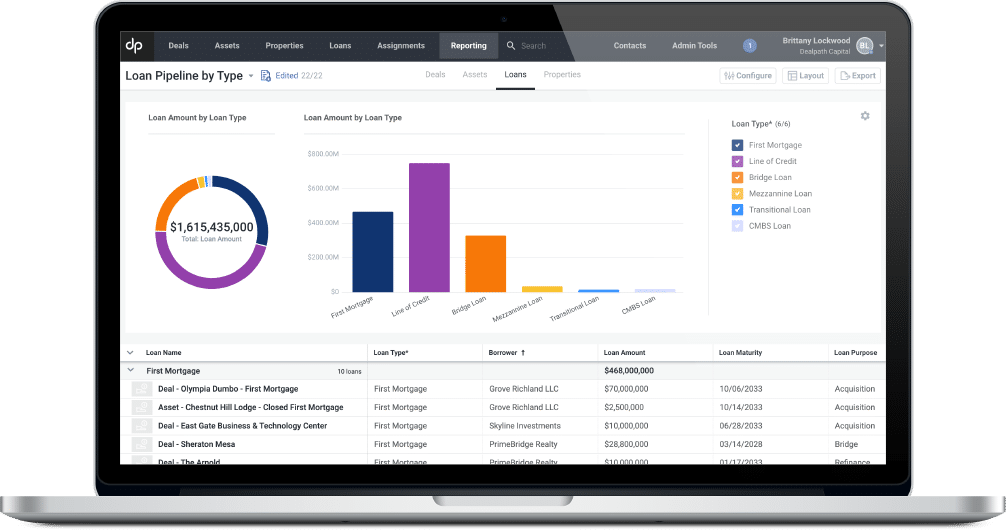

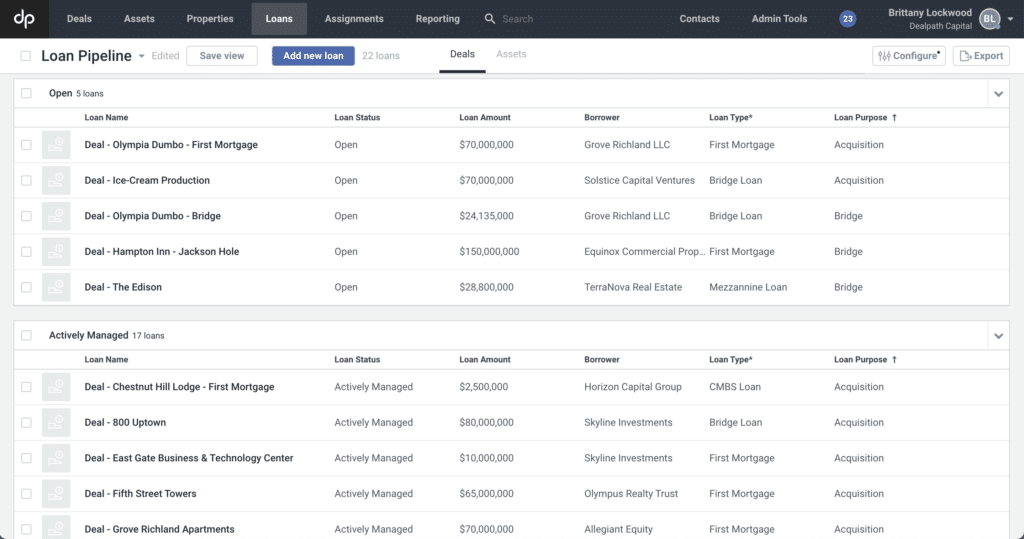

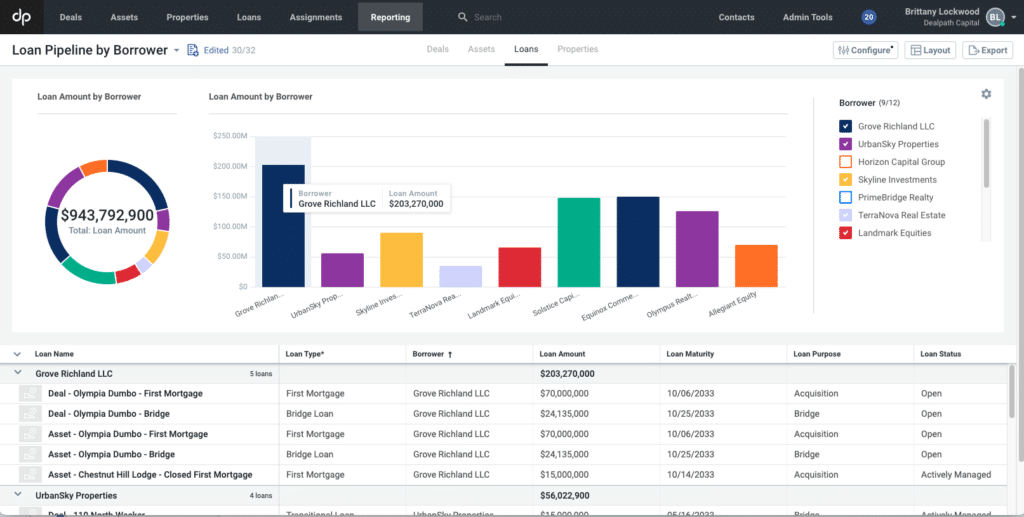

Gain visibility into all debt origination pipelines and metrics across regions and teams

Centralize institutional knowledge across your firm, while improving data-driven screening, underwriting and evaluations

Configurable and automated task management to improve operational efficiency

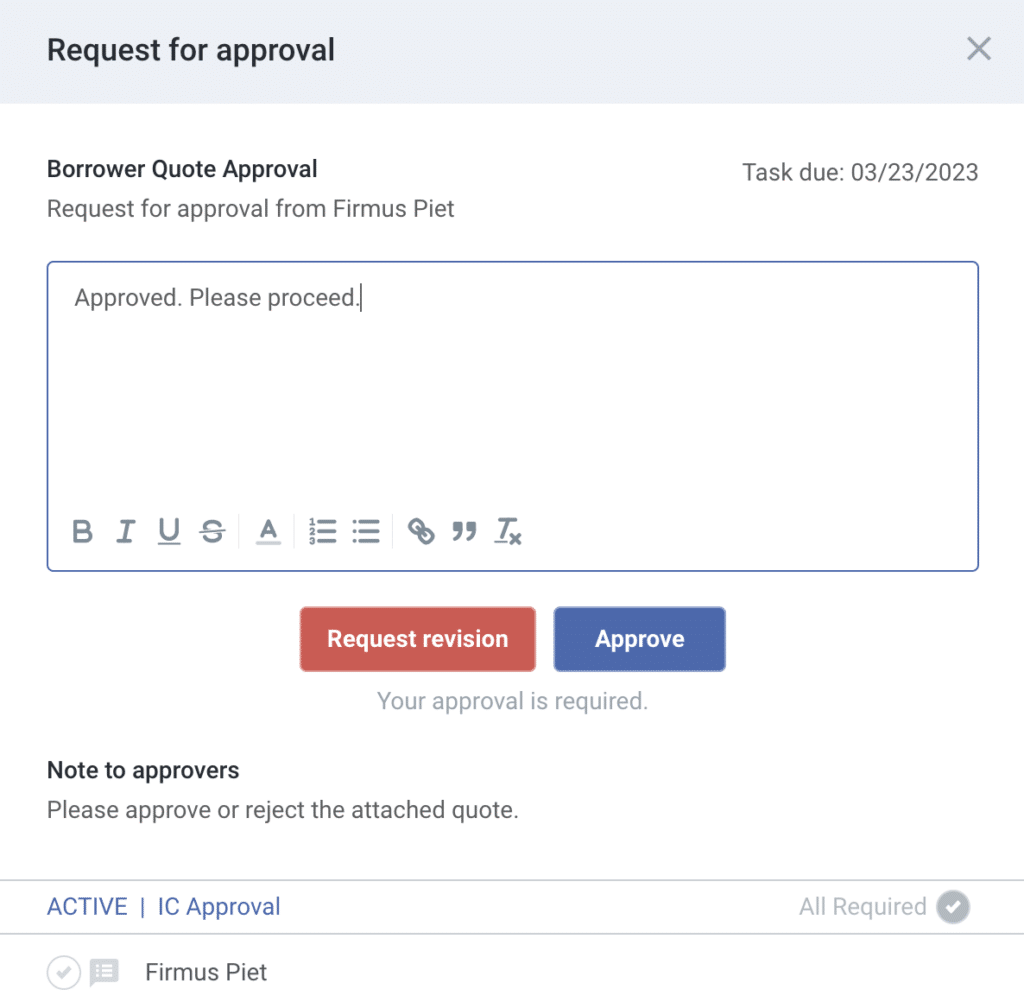

Manage sign-off from multiple stakeholders by assigning, tracking and recording all necessary approvals from loan creation to close in one centralized place

Using Dealpath’s data analysis and reporting capabilities, users have evaluated over $10 trillion in investment transactions and counting.

Dealpath is SOC 2 Type 2 compliant and committed to delivering secure, resilient and highly available cloud-native applications and data services to our clients.

Every day, thousands of professionals from leading investment management firms rely on Dealpath to track real-time deal progress.

Stay in the loop about deal management best practices, upcoming events, industry trends and more.