COMMERCIAL REAL ESTATE LOAN ORIGINATION SOFTWARE

Dealpath for Debt

Dealpath enables CRE lenders and debt investors to manage their loan and origination pipelines, execute on complex debt deals, and track their loan portfolios.

Dealpath enables CRE lenders and debt investors to manage their loan and origination pipelines, execute on complex debt deals, and track their loan portfolios.

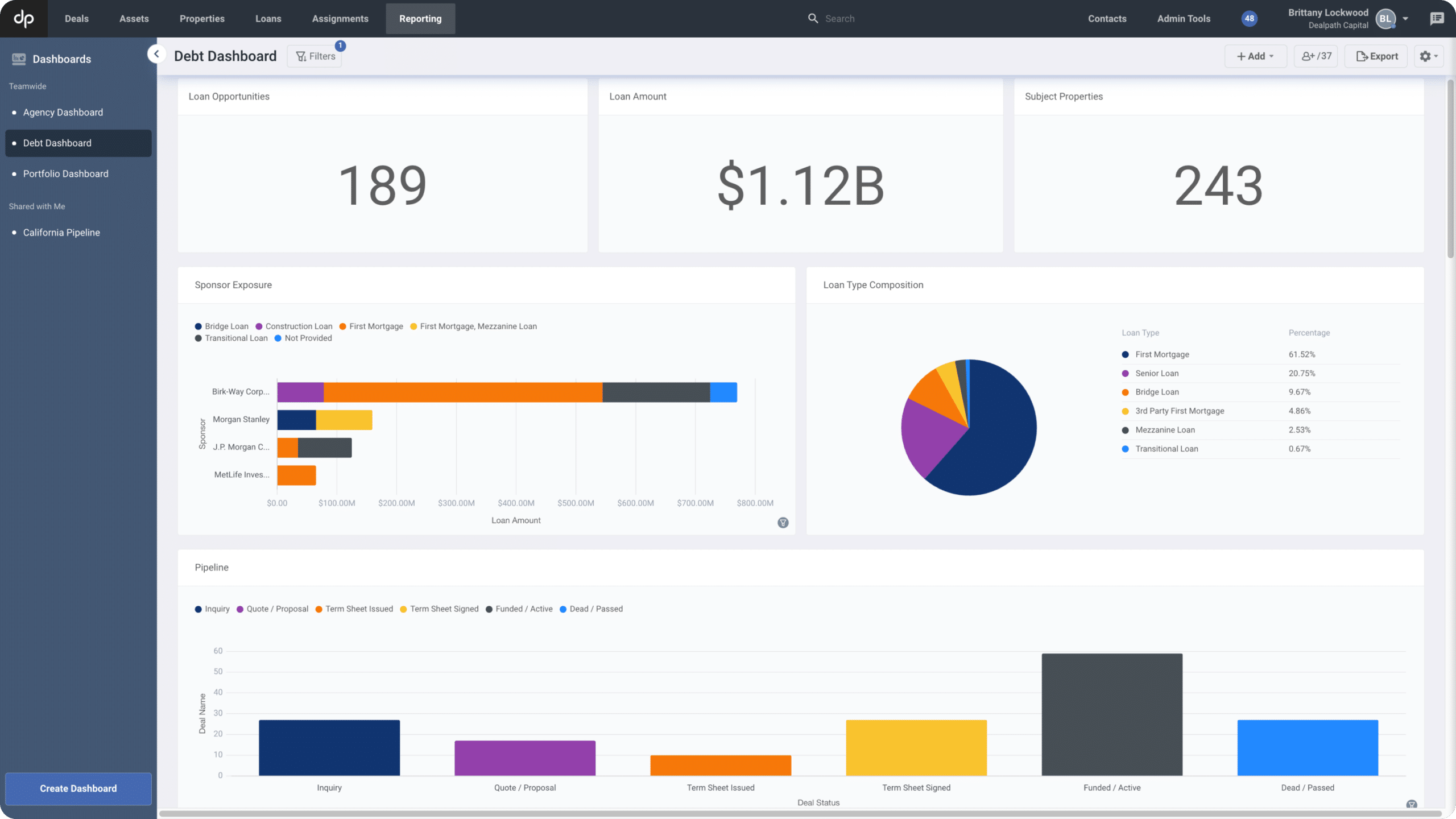

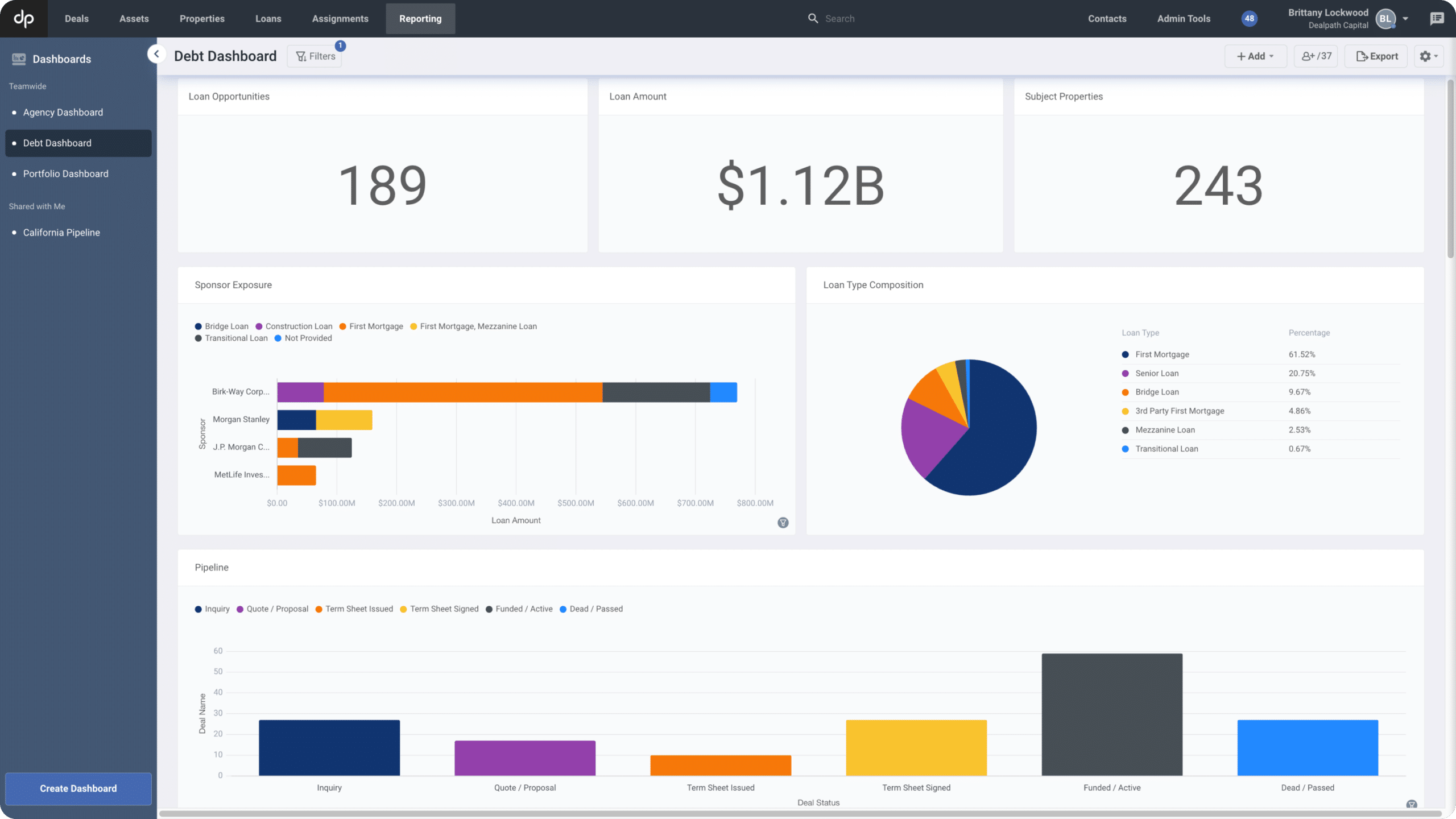

Consolidate loan data and market intelligence in a centralized database and leverage it through reports that provide actionable insight into your loan pipeline and portfolio.

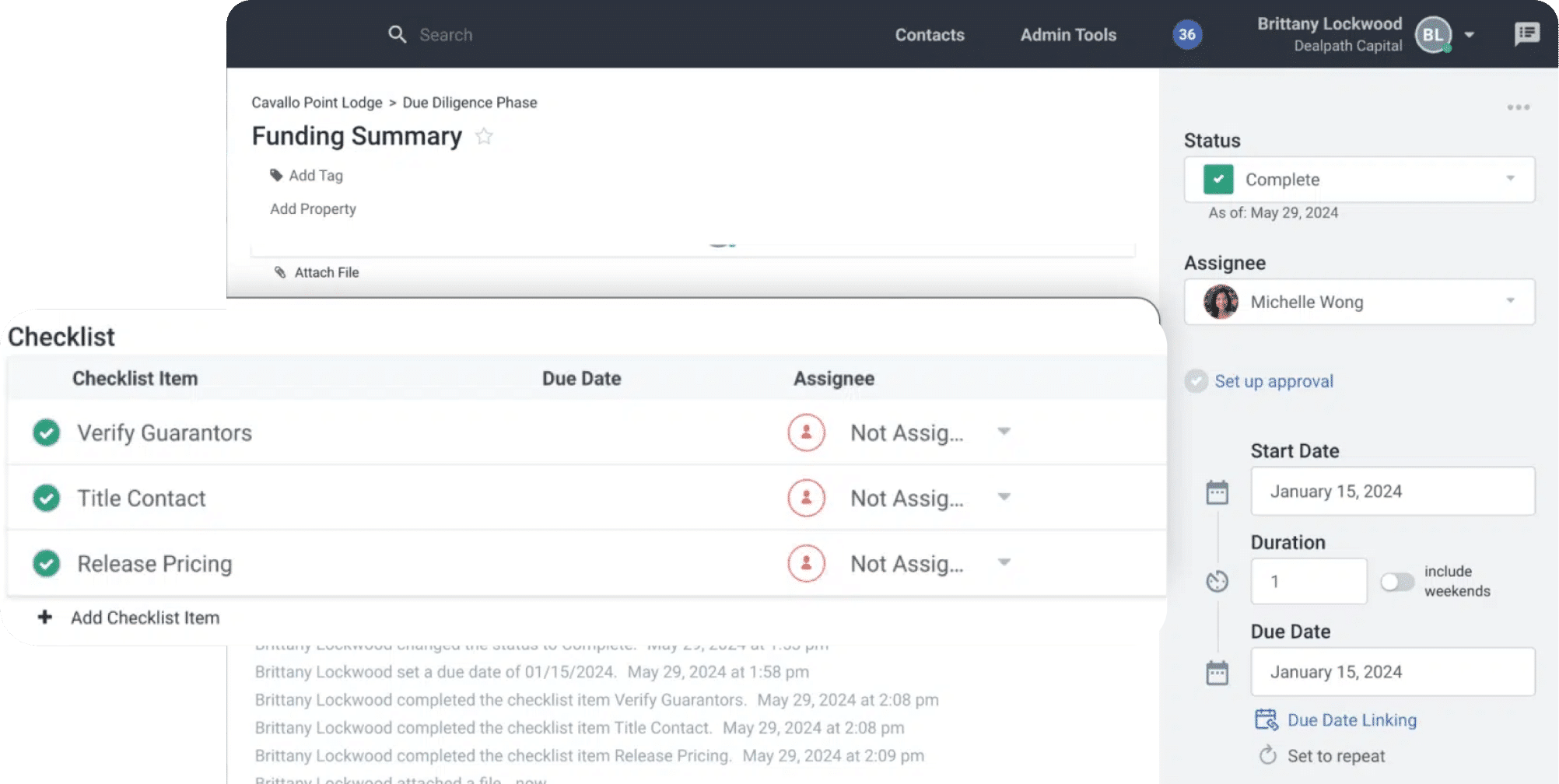

Turn complex processes into repeatable workflows that help you collaborate with your team from sourcing to underwriting, build operational efficiencies, and close on competitive timelines.

Surface potential issues earlier in the underwriting process by tapping into your proprietary database to validate loan underwriting assumptions, and monitor the health of your portfolio.

From sourcing to portfolio management, Dealpath helps CRE lenders make better decisions and keep their debt pipelines moving.

Screen incoming debt deals and track your origination pipeline.

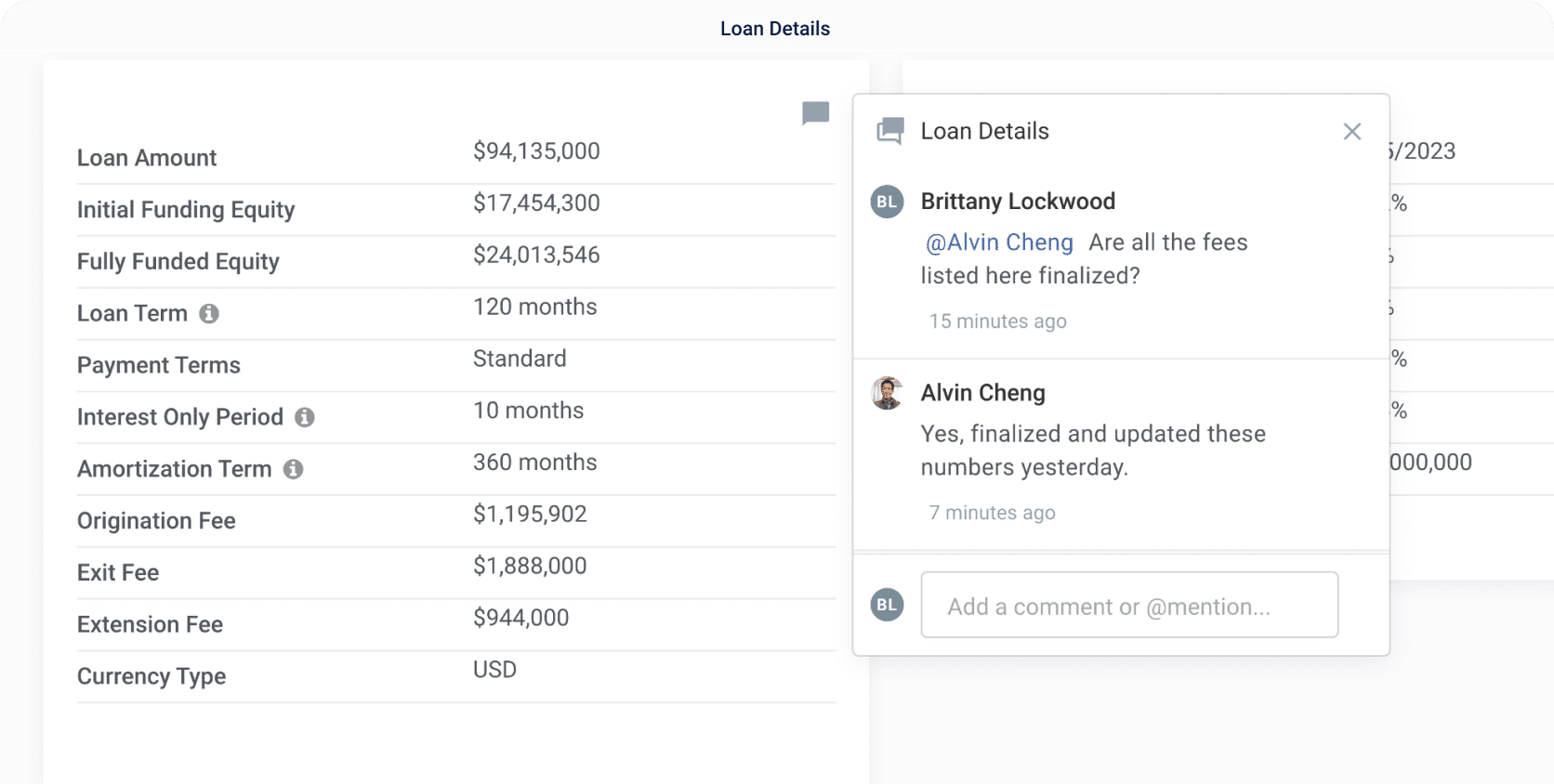

Capture every debt deal that crosses your desk, track key loan metrics, including terms for different loan types, and automatically generate term sheets.

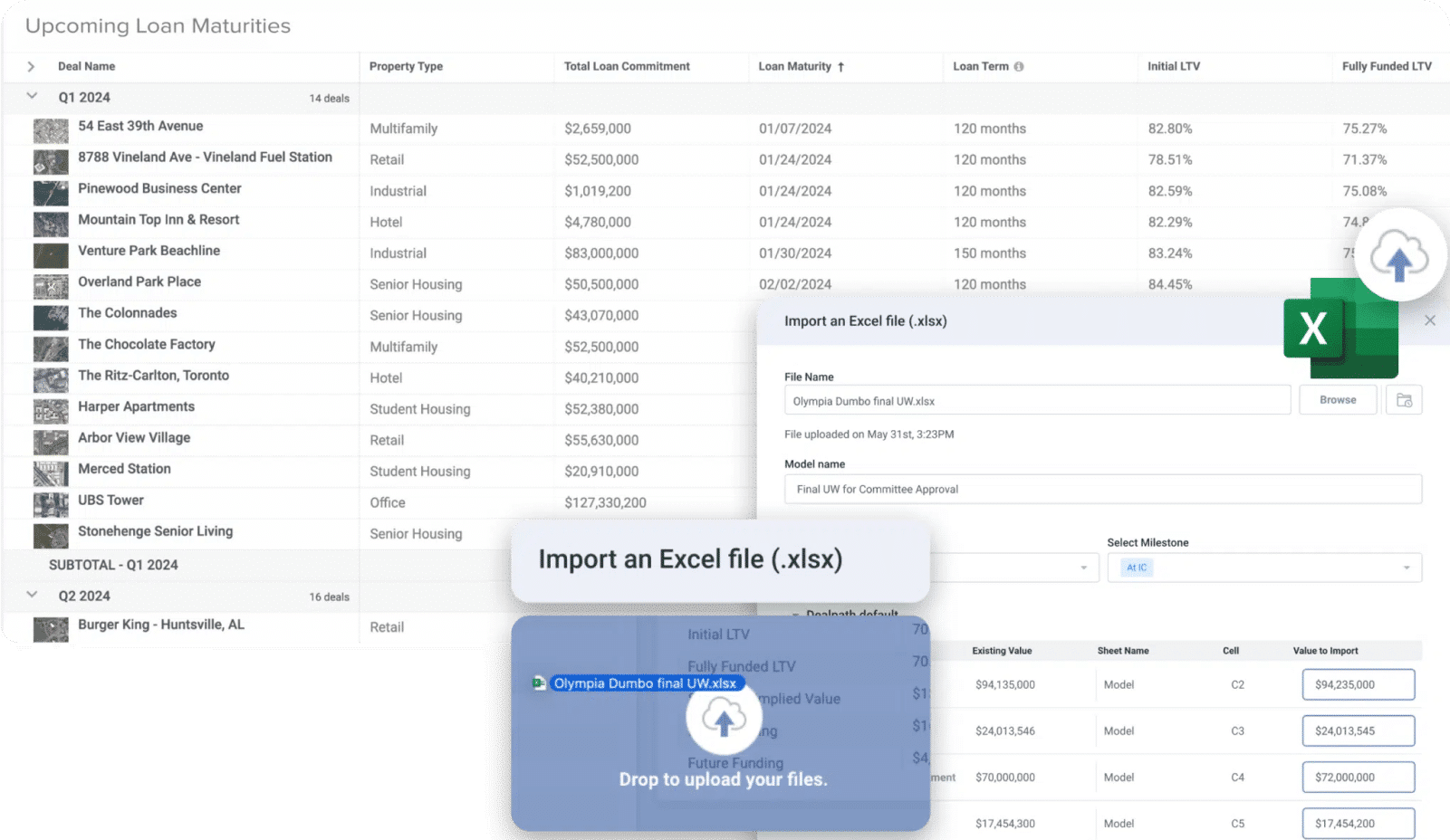

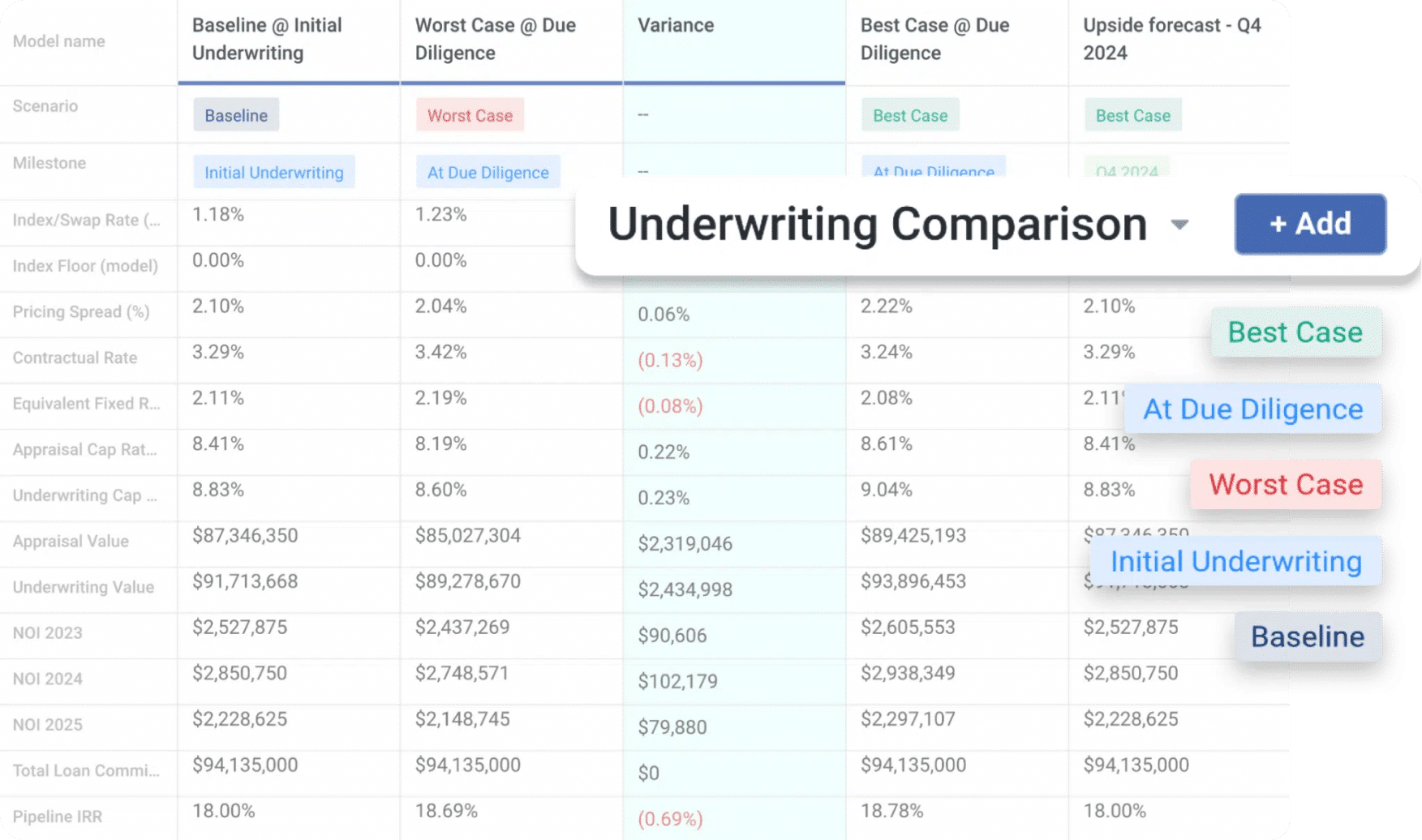

Compare underwriting models and manage complex workflows.

Leverage a database of market intelligence, compare underwriting models for different scenarios, and execute repeatable due diligence processes.

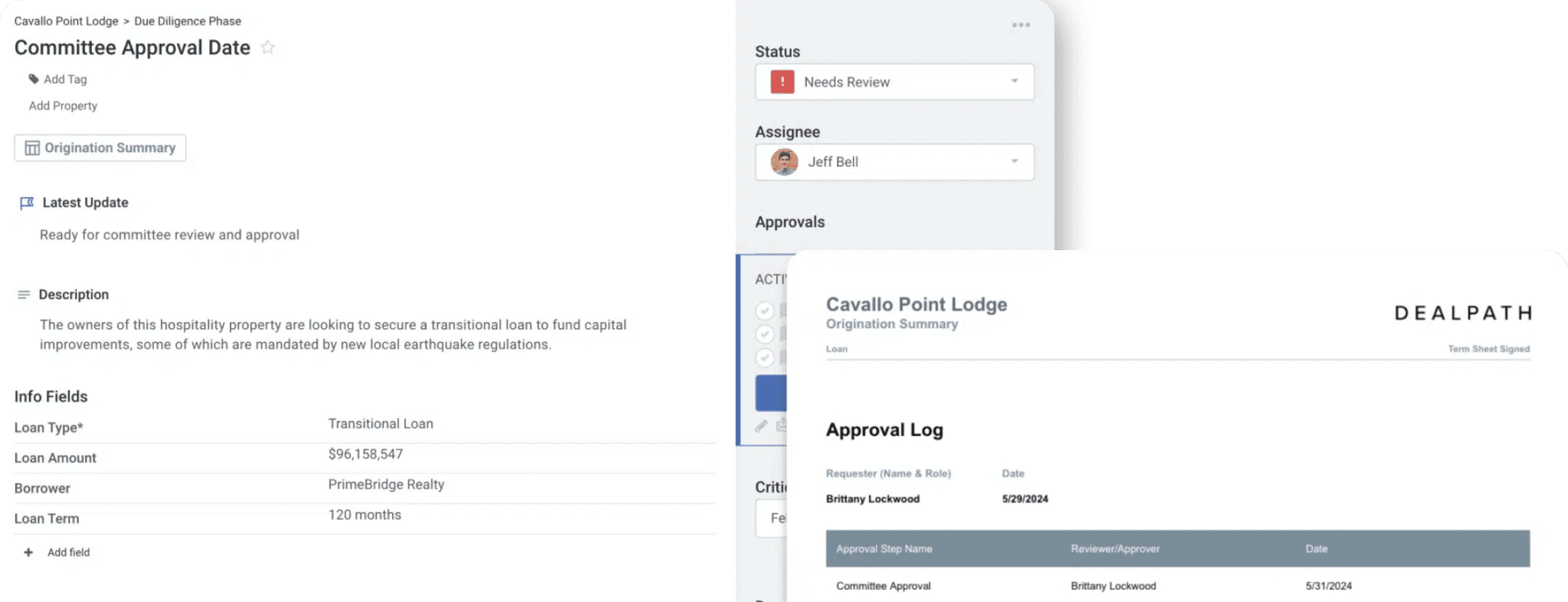

Generate credit memos and record closing details.

Expedite decisions by creating and sharing credit memos, requesting and recording approvals, and memorializing information for downstream teams.

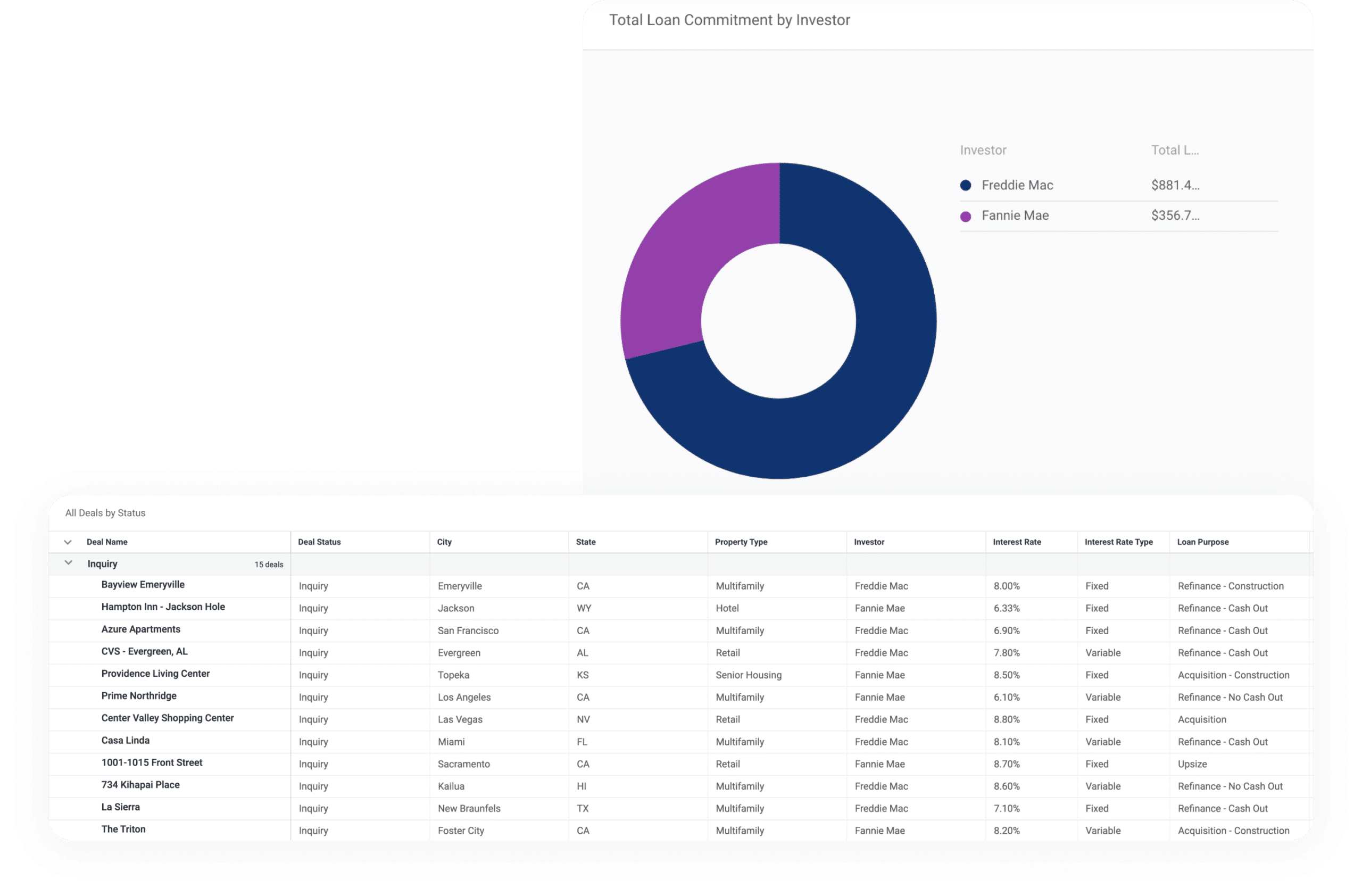

Monitor your portfolio health and track loan covenants.

Customize dashboards to analyze your portfolio and monitor covenants including DSCR, debt yield, and LTV ratio.

Stay in the loop about deal management best practices, upcoming events, industry trends and more.