Single family home rentals represent the fastest-growing sector of the American housing market. Once dominated by small “mom-and-pop” shops and individuals, the single family rental space has now garnered the attention of large-scale institutional investors, which have traditionally been focused on core asset classes like retail, office, and multifamily. In recent years, these giants have poured billions into development as the sector grows amidst explosive demand.

In this article, we’ll explore the trends surrounding exponential growth in the single family home rental market, and recent activity signifying the larger opportunity ahead.

Single Family Home Rentals: A New Pursuit for Institutional Investors

Investments in single-family rentals have grown dramatically in recent years, but particularly as the pandemic began reshaping lifestyle trends. In 2020, the sector saw $3 billion in investments. By the end of 2022, investments into single family rentals nationwide are expected to reach $50 billion.

Institutional investors, homebuilders and commercial developers alike are flocking towards this hot market at record pace. In an unpredictable market, SFR offers relative stability, making these properties and portfolios a reliable diversification channel. The number of newly constructed single family rental homes jumped by 30% from 2019 to 2020. Although this represents only 6% of all new homes built in the United States, this figure could double over the next decade.

The Difference Between Multifamily and Single Family Rental Investing

Multifamily complexes hold a number of different units, from duplexes that host two families to high-rises with hundreds of units. Single family rentals, on the other hand, have only one dwelling unit. Although many investors and developers build single family rentals concurrently, each unit is a standalone housing property that is not attached to any other structures.

There are notable financial differences between multifamily buildings and single family rentals as well. In comparison to multifamily units, single family rental investing present lower upfront costs, as many homes are priced between $300k to $400k. The market for individual units is also significantly larger, meaning investors can liquidate their positions with relative ease if necessary.

By contrast, multifamily properties tend to have a lower cost per unit and can generate higher cash flows. There are, however, a number of risks, including frequent tenant turnovers and smaller pool of potential buyers.

Why Investors Have Flocked to Single Family Rentals

The single family rentals market offers a number of appealing benefits to investors looking for new diversification channels.

Housing Shortages

The U.S. housing market has been grappling with housing shortages for years, within both rental and buyer’s markets. Estimates pinpoint the housing shortfall at somewhere between 1.6 to 3.8 million homes nationwide.

The lack of available housing has skyrocketed rents and home prices to record levels. Single family home rents are now up more than 13% from a year ago, according to CoreLogic.

Steady cash flow

The high demand for single family rentals has also turned investors’ eyes to the more traditionally appealing aspects of this market: stability. Single family home rentals tend to boast steady cash-flow, stable returns, as well as competitive rent growth. Many single family home renters regularly bring in six-figure incomes, yet choose to rent for a variety of personal reasons.

Tenants in single family homes also tend to stay longer and have lower delinquency rates in comparison to traditional renters. People always need a place to live, meaning filling vacancies could be easier than with other asset classes.

Robust demand

Demand for single family home rentals is robust, partly driven by Millennials, many of which have been priced out of homeownership. But many Americans also choose to rent in order to avoid the pitfalls associated with owning, such as maintenance, down payments, and long-term commitment.

Single family rental homes can be incredibly convenient and accessible. Before renting them, it’s not uncommon for investors to follow a value-add strategy by remodeling the home. This enables landlords to charge a higher price for rent, while renters can enjoy a more modern feel without the upfront costs of a full-scale renovation.

Despite a steady climb, this demand has drastically increased in the wake of the pandemic and the shift to remote and hybrid work environments as Americans seek more space.

Emerging Trends in Single Family Home Rental Market

Some of the world’s largest institutional investors have already capitalized on the opportunity in the single family rentals market, including UBS, Blackstone, Nuveen, Oxford Properties, Principal Real Estate, Bridge Investment Group and MetLife.

In 2020, Nuveen announced a $400 million investment into single family rental startup Sparrow. Meanwhile, Bridge Investment Group launched a $1 billion single family home rental fund in early 2022.

Blackstone has also doubled down on this fast-growing space. In June, the institutional giant made headlines for deploying $6 billion in single family home investing, via the Home Partners of America. In just one additional transaction, the investment giant upped its commitment by another $1 billion by purchasing a new 17,000 single family rental home portfolio.

Optimizing Single Family Home Investing

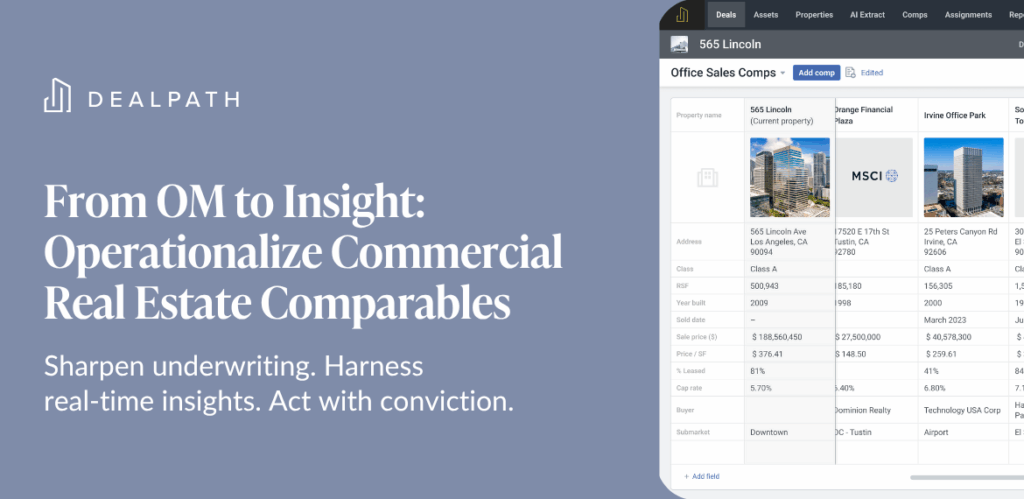

To win in a highly saturated competitive market, your firm must be equipped to deploy capital on the most profitable opportunities. Industry-leading developers rely on Dealpath to boost speed to market by managing development projects from screening, through planning and execution.

Download our eBook, 4 Tactics To Simplify, Standardize & Scale Development Projects, to learn how leading developers modernize project management to invest at scale.