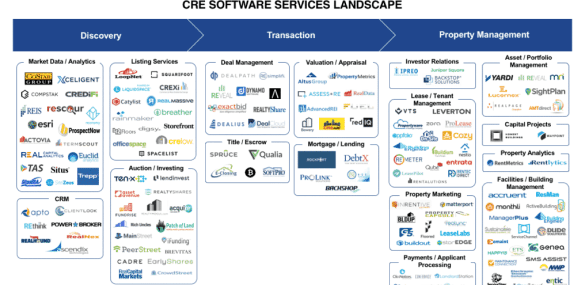

To date, investors have poured $33.7 billion in funding to real estate startups – up from just $2.4 billion in 2008. As a result, the CRE tech landscape has a new problem. It’s become crowded, and for many, it’s downright confusing.

Given the sheer number of software services in CRE tech, their core competencies can sometimes be vague or appear to overlap. CRE tech firms have traditionally been oriented based on technology or trend, making it difficult to understand when and how to extract the most value. Firms shopping for new software can struggle to parse lease management from deal management or differentiate between market analytics and property analytics.

Dealpath recently joined Bisnow to help make sense of the convoluted CRE tech landscape. Our strategy divides the landscape into three distinct categories: Discovery, Transaction, and Property Management.

Discovery

In the CRE tech landscape, the discovery category is centered around market research and listing services. The marquee names include CoStar, Loopnet, and Compstak, supplemented by a host of smaller startups and CRM offerings. Discovery services constitute the first step in the long and complex CRE acquisition process.

Transaction

The next phase of a CRE deal is powered by transaction software. This category is made up of valuation services like Altus Group and redIQ as well as deal management solutions like Dealpath. The Transaction category is designed to monitor deal pipelines, streamline workflows, mitigate risk, and provide accurate valuations to help execute deals.

Property Management

Finally, property management software helps owners and landlords optimize their properties. Solutions like Yardi and VTS are typically used post-sale to manage tenants, leases, and properties. These services are some of the most well-established brands in CRE.

The CRE tech landscape is in a period of dynamic maturation. Alongside innovative, smaller companies and larger, more established firms, we’re beginning to see mergers and active acquisitions. There’s no doubt that the CRE tech landscape is consolidating, but when the dust settles – despite inevitable crossover – the landscape will still be defined by these three categories.

For a deeper dive into the CRE tech landscape, be sure to read the full Bisnow article featuring insights from CEOs Mike Sroka of Dealpath and Elliot Vermes of redIQ.