Managing your deal pipeline, tracking ahead of critical dates and keeping a real-time pulse on next steps is challenging in a rapidly changing market where conditions are shifting and investor expectations are at an all-time high. Relying on manual processes and fragmented tools like spreadsheets, emails, and shared folders can create executional friction for even the most talented teams. Minor confusion on details like closing dates or underwriting scenarios can cost an entire team hours of time on drawn-out meetings–which, ultimately, may not end in actionable outcomes.

Dealpath, real estate’s largest and most trusted deal management platform, offers firmwide, real-time visibility into the latest pipeline updates to keep teams aligned and closings on track. Consequently, deal teams can simplify discussions by recording and clearly visualizing relevant details. Read on to learn how deal teams can expedite or eliminate pipeline, critical date and due diligence meetings on Dealpath.

A Centralized Source of Truth Powers Real-Time Decisions & Collaboration

As your firm ingests, manages and executes on deals in its Dealpath pipeline, all corresponding data, documents, comments, task notes, upcoming critical dates and other details are captured. Clear, real-time visibility into the latest progress allows anyone in your firm to view updates–or even receive notifications about actionable changes.

Managing your deal pipeline in one source of truth creates powerful efficiencies, allowing teams to collaborate in the context of data and make confident decisions. Centralizing this information could save your team hours of time spent on admin work and meetings on a weekly basis–instead of lengthy meetings that end with a plan to circle back, you can hold concise, productive conversations.

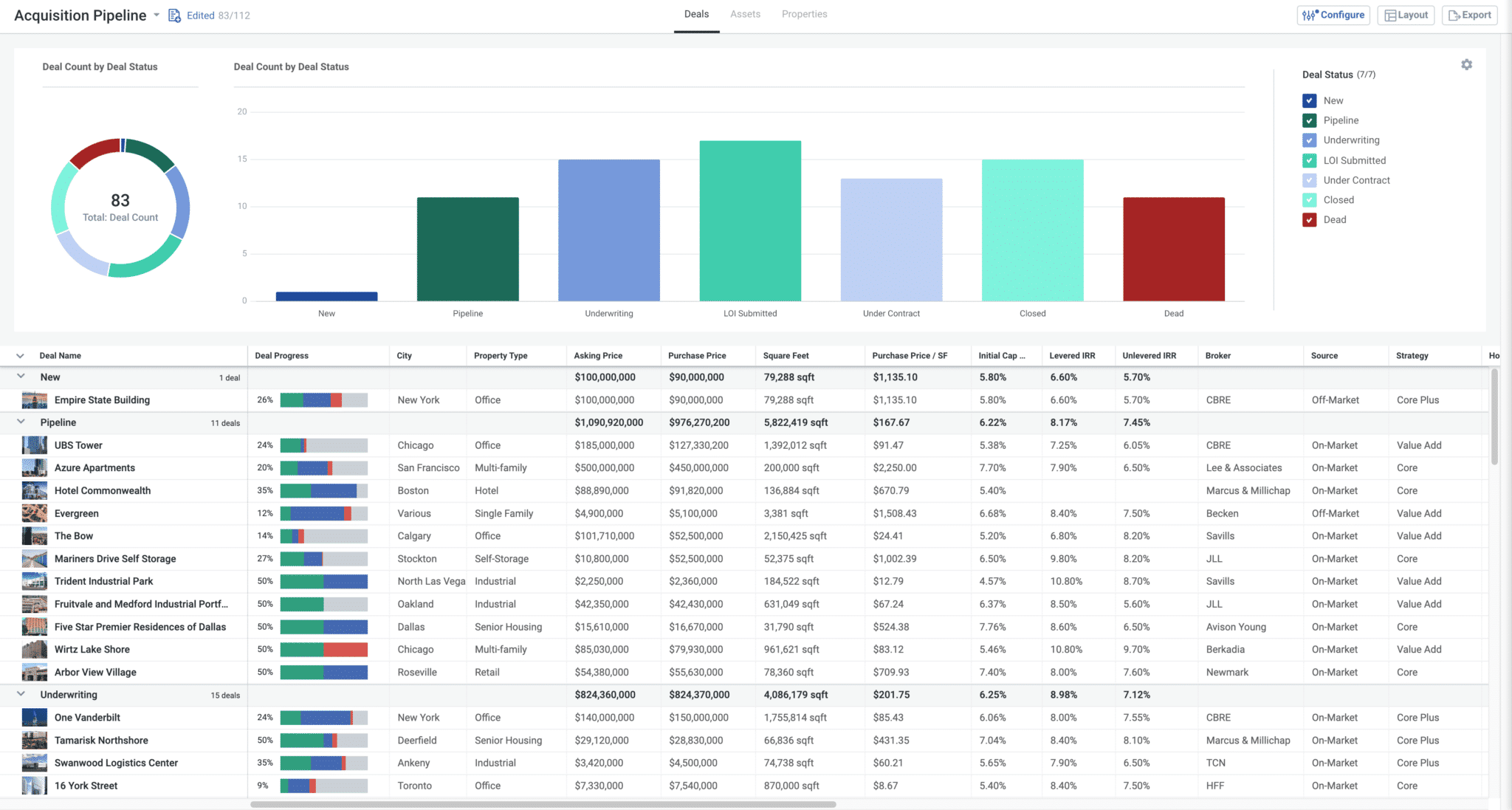

1. Run Your Pipeline Meetings on Dealpath

It’s not easy to hold a pipeline meeting when your deal team is relying on inconsistent, manually updated spreadsheets, only to leave on a note of uncertainty. Dealpath’s pipeline reporting enables firms to hold focused, productive conversations based on real-time, centralized information.

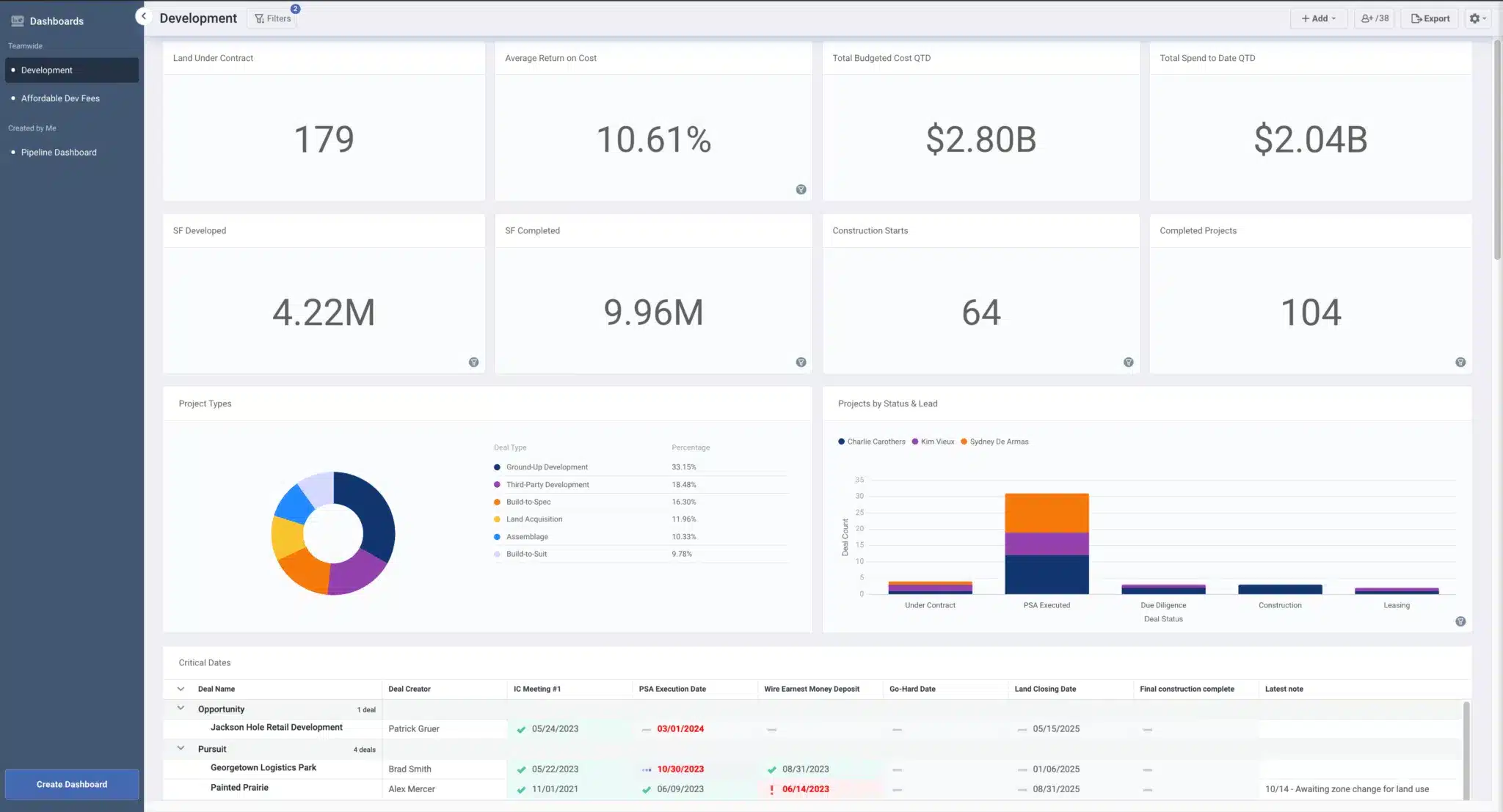

As team members update deals in Dealpath, relevant information is captured in real-time deal overviews and reports. During pipeline meetings, your team can simply present that report and discuss updates, like progress against critical dates or milestones, financials, and next steps for deal execution.

For a broader overview, deal teams can even zoom into specific markets, deals of a certain size or stage to understand progress. Consequently, management and senior leadership can more confidently project closing timelines, or even create agendas within Dealpath about talking points for Investment Committee meetings.

Running your pipeline meetings on Dealpath empowers your team to make faster, more confident decisions based on cleaner, more accurate data, so you can execute next steps immediately and move on to the next deal.

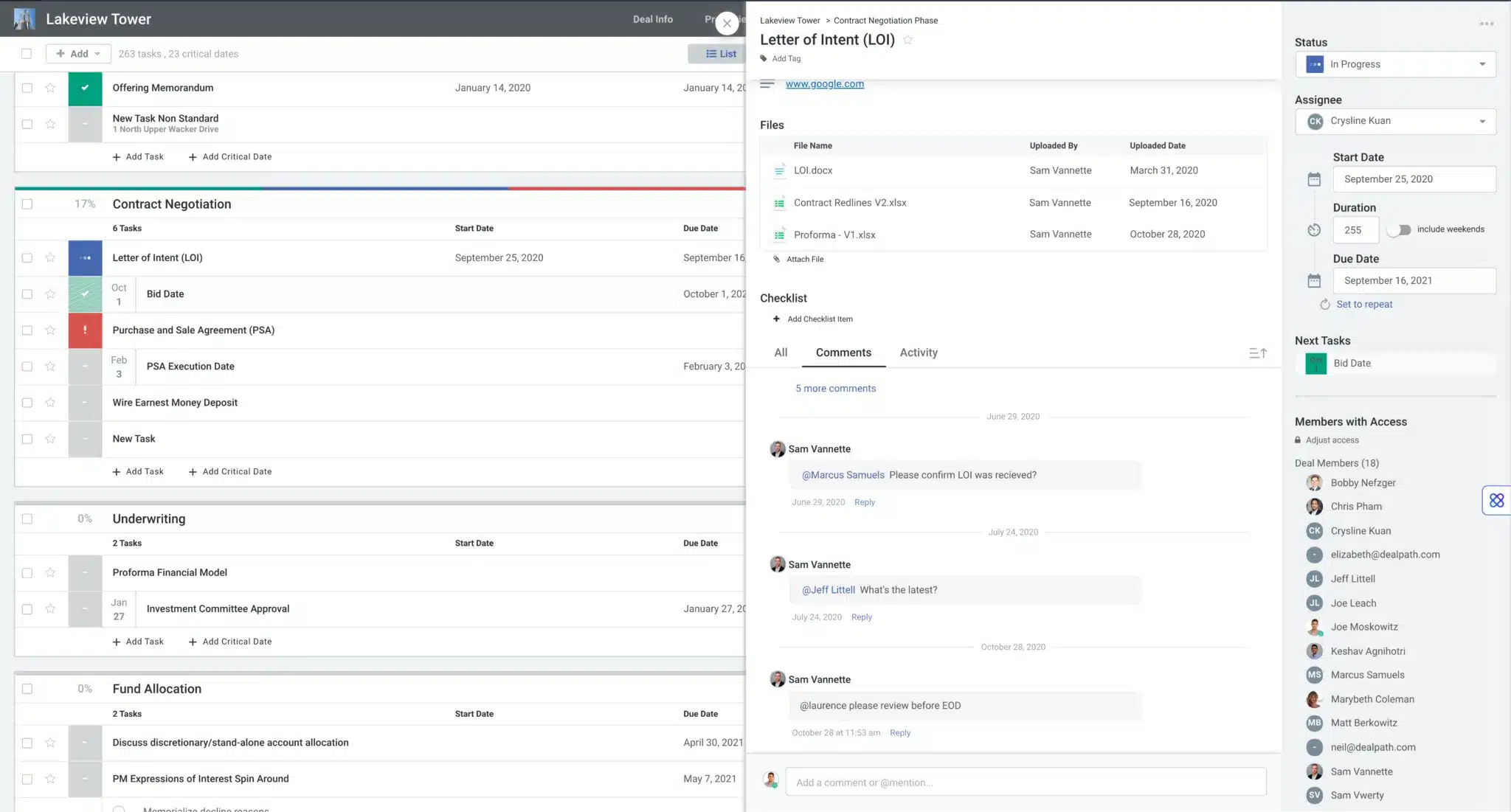

2. Eliminate Due Diligence Tracking Meetings with Dealpath

Reviewing due diligence checklists line by line in team meetings is no longer the only option. Dealpath automates execution checklists from sourcing through diligence and closing, helping teams to cover every base and collaborate in lockstep.

As deal team members collaborate to complete checklist items, managers and executives can view progress on transaction workflows in full detail. Configuring custom notifications in Dealpath even allows specific team members to receive notifications about relevant updates throughout execution.

Team members looking for updates—whether it’s a site inspection or contract status—can instantly access that information in Dealpath, eliminating the need to hunt through spreadsheets, send urgent emails or wait for the next due diligence meeting. All commentary, documents, and other details are visible in this single source of truth, which memorializes this information long after the deal closes or employees leave. With all deal information centralized in Dealpath, teams can stay aligned, move faster with fewer meetings, and keep every closing on track.

3. Run Critical Date Tracking Meetings on Dealpath

Missed critical dates can be costly, whether your firm loses a deposit, suffers the opportunity costs of a delayed deal, or–in a worst-case scenario–loses it to the competition. Firms managing their deals in Dealpath can track critical dates in real time, helping them prioritize the right deals.

Pulling a report of all deals based on critical dates provides all the information your firm needs to quickly analyze these timelines. Depending on your firm’s priorities, you can examine this from a 40,000 foot view, or dive into the weeds of discussing next steps on high-impact deals. If timelines have changed, deal team members can dynamically shift change related dates in one click, preventing the need to manually account for delays. Teams can even enforce this accountability by governing how these deals are tracked by, for example, requiring critical dates for every deal.

After reviewing critical dates, your firm can reassign work as needed to prioritize the most profitable opportunities.

Simplify All Your Meetings With Dealpath

With real-time visibility in Dealpath, deal teams can simplify virtually any meeting—whether recurring or ad hoc—by starting from a shared source of truth. Whether it’s a pipeline review, a strategy sync, or a cross-functional touchpoint, the most up-to-date information is already captured, organized, and accessible. That means fewer status checks, less back-and-forth, and more meaningful, insight-driven conversations that actually move the deal forward.

Leading With Data: 3 Reporting Tips to Fuel Your Digital Deal Advantage

Ready to learn how your team can view updates in real time, prioritize profitable ones and make better informed decisions? Request a demo to learn why over 300 firms, including Blackstone, Nuveen, LaSalle, CBRE IM, and MetLife trust Dealpath for real estate deal management.

Request Demo