For institutional real estate investors, the path to success in a competitive market hinges on a well-oiled deal pipeline, which teams can pare down to identify the most profitable opportunities. Building that pipeline with every relevant target market deal, though, is easier said than done. To cast the widest net, investors generally find deals through brokerages, online markets, and even relationships that might offer commission-free off-market deals. Read on to learn how investors source commercial real estate deals, both on and off of the market.

How to Find Commercial Real Estate Deals: Identifying Your Target Market

Your firm needs a large pipeline to act on the most profitable deals, but not all deals present the same opportunity. Institutional investors follow differentiated investment strategies, typically focusing on certain markets, asset classes and cap rates. One investor might reject a class C industrial building in Chicago due to high risk, while this might fit squarely into another’s portfolio. Similarly, another investor might pursue a class A office building to gain recurring revenue, even as other investors pass due to sky-high prices. To build the right pipeline, your firm must look in the right places.

What Are Off Market Commercial Real Estate Properties?

In an effort to offload assets as quickly and seamlessly as possible, many firms choose to sell and promote these sales through brokerages. The market is rife with highly advertised deals, but the best ones may be under the radar entirely. Off-market commercial real estate deals are properties that are for sale, but for one reason or another, are not marketed by brokers.

Instead of listing a deal on a listing service, off-market deals might be offered by an agent, brokerage, or even the owner.

The Benefits of Finding Off Market Commercial Real Estate Deals

So, why would you try to find off market commercial real estate deals when you can easily check a listing service? There are numerous advantages that come with unlisted properties on both sides, and buyers can benefit in the following ways:

- Early Access: Gain a competitive advantage by starting to review the deal before it’s publicly available to other firms, closing the right deals sooner and faster.

- Exclusivity: You can only find off-market commercial real estate deals via relationships and by word of mouth. As a result, fewer players compete for them.

- Potentially Lower Price: The simplicity and peace of mind in selling to an off-market buyer might compel some sellers to consider lower prices.

- Higher Profits: When dealing directly with an owner, rather than a broker, you won’t have the obligation of paying a costly broker fee. However, many off-market deals are made through brokers, meaning buyers must pay fees and commissions–though they might be lower.

- Flexibility: Because your firm won’t be negotiating with brokers, there is more flexibility and less red tape involved in the transaction.

- Tenant Stability: Finding off-market commercial real estate deals means that tenants won’t be insecure about their position, which may

While not all benefits apply for every deal, off-market properties offer unique opportunities with less red tape than on-market deals.

How to Find Off-Market Commercial Real Estate Deals: 5 Tips

Finding off-market commercial real estate deals is not fundamentally different from sourcing listed deals, but there are a few tactics you can follow to find more opportunities. Generally, investors must be diligent in their outreach and communications, keeping their ears to the ground for deals that fit their profile.

1. Build Strong Broker Relationships

Buyers can find off-market commercial real estate deals and avoid commissions altogether when the right listings pop up organically, but brokers can also be a strong source of unlisted deals. Due to their expansive transactional networks, brokers are constantly in touch with owners seeking to sell, as well as other brokers. Beyond relationships, a broker’s extensive digital tool set can also pinpoint opportunities that are not formally listed.

As your firm continues to grow and transact in the market, the relationships you forge can carry significant value. Proving that your firm is not only positioned for growth, but prepared to execute, can go a long way. Brokers are incentivized by sales, meaning they will work diligently to find properties for interested buyers.

2. Forge Strong Industry Relationships

Beyond brokers, other industry relationships can also play a meaningful role in sourcing off-market deals. From contacts at other firms, to contractors, title companies, property managers, and legal or environmental teams that might work with sellers, staying in touch can prove beneficial.

3. Property Websites & Area Building Databases

By definition, they won’t be publicly listed on the most popular listing services, but it’s possible to find off-market commercial real estate deals on other listing websites like Zillow. Even if properties are not designated as “for sale”, these databases might hold the most recent sale date, price, square footage, and other essential details. While not necessarily a scalable tactic for institutional investors, this is another way to find commercial real estate deals off-market.

4. Contacting Owners Directly

It’s not uncommon for real estate investors to notice appealing buildings, reach out to owners and make an offer. Depending on the markets you’re investing in, this may or may not be a viable strategy. Because this approach hinges on another’s approval, it might be more effective for owner/operators than institutional investors, who tend to be more calculated and systematic in their timing. Some owners might entertain the idea, but it’s also important to note that not all owners are in the market to sell, making rejections relatively likely.

5. Direct Mail

Unlike online research and cold calling, sending direct mail to properties owners whose buildings meet your criteria can cast a wider net. For this reason, direct mail is the most scalable of these three outreach strategies. Because marketing companies can shoulder the burden of printing and distributing these mail pieces, the hard work lies in building targeted lists.

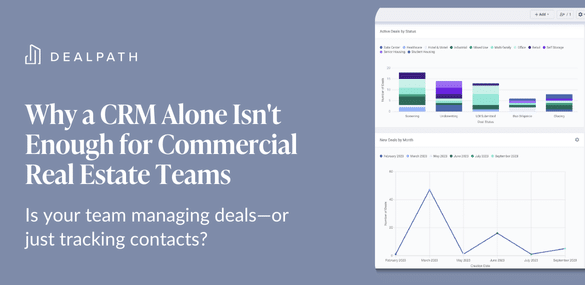

Managing On- and Off-Market Commercial Real Estate Deals with Speed & Efficiency

Whether your firm sources on- or off-market deals, collaborating in lockstep–with real-time visibility into existing opportunities and historical comps–is paramount. Deal management software has enabled institutional firms to amplify their success by systematizing data-driven decisions.

Download your free white paper to learn more about how you can augment your existing commercial real estate pipeline process.