Real estate acquisitions are evolving. Amidst shifting market dynamics, executives and LPs are demanding more data to support faster decision-making and hone in on the best deals. Yet, many still rely on fragmented processes, spreadsheets, and manual workflows that slow decisions and execution.

The shift to systematized, data-forward acquisitions is unlocking new possibilities in real estate investing, and the ability to adapt will define the winners in an increasingly competitive landscape.

In this blog post, we explore five trends that are reshaping real estate acquisitions, from digital deal sourcing, to real-time dashboards, compliance-focused execution, and more.

1. The Rapid Acceleration of Digital Deal Sourcing and Data Capture

Finding and screening deals has long been a manual process reliant on scattered emails and spreadsheets, leading to missed opportunities. As market activity accelerates, capturing every OM or flyer that crosses your desk–and the data trapped inside–is critical to maintaining your competitive edge.

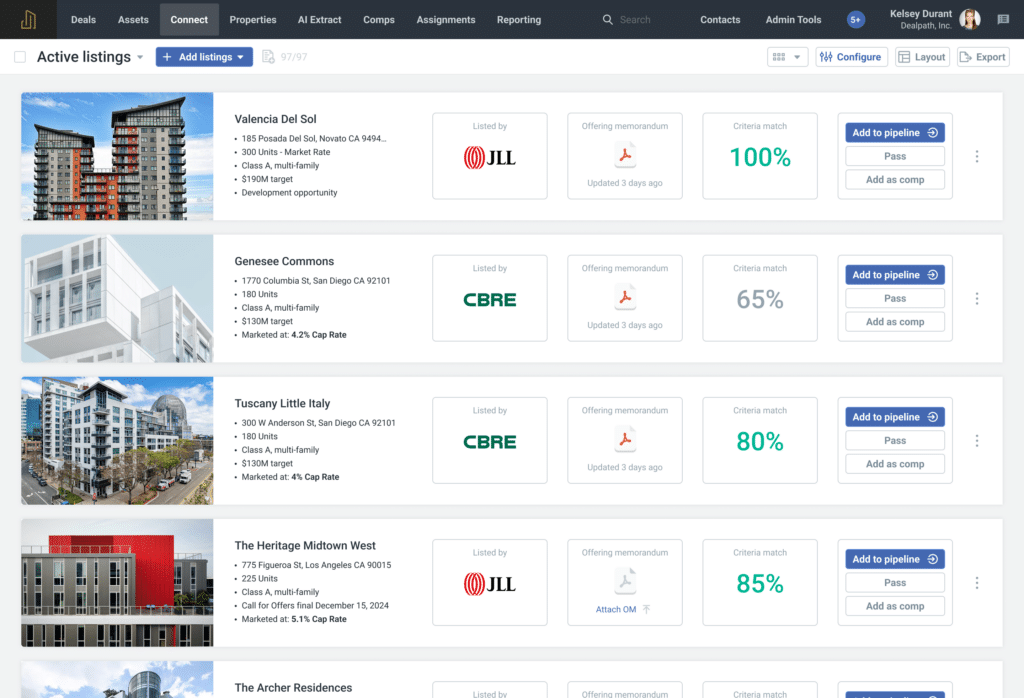

Once the sorting ground for new deals, email inboxes may recede into the background as a deal sourcing and distribution channel. The paradigm shift toward structured, automated deal sourcing is making it easier for firms to review more deals and prioritize the best ones. For example, Dealpath Connect injects property listings from leading global brokerages like JLL and CBRE directly into buyer pipelines, allowing buy side investors to see every relevant deal, stay abreast of market trends, and make strategic decisions.

AI is also playing a role in accelerating deal sourcing. Dealpath’s AI Extract automatically extracts information from OMs, CIMs and other flyers, standardizing and structuring the data to meet your firm’s unique investment strategy directly in your pipeline or comparables database.

Whether you pursue the deal or pass, these automated tools turn raw information into intelligence that strengthens your proprietary property database, helping you capture exponentially more comps and make better decisions over time.

Capturing more deals means maximum optionality, enabling your firm to close on the right ones and advance its data strategy.

2. Driving Smarter Decisions With a Proprietary Comps Database

Acquiring data like comparables, underwriting assumptions, leases, and historical performance—and wielding it effectively—are two different things. When key insights are buried in spreadsheets or siloed across teams, you risk leaving powerful data on the table, missing a lucrative opportunity, or making a misinformed decision.

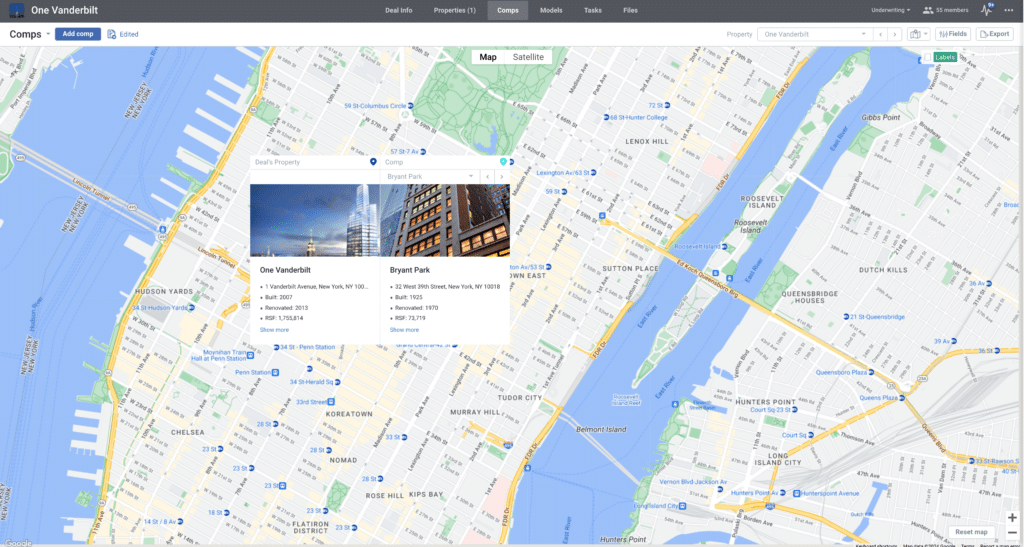

Seeking a way to build and activate a proprietary data advantage, firms have adopted standardized databases, like Dealpath, to tap into intelligence for superior decision making.

Dealpath’s data platform empowers firms to memorialize information by centralizing active deals, comparables, dead deals, and owned assets in one place. Whether they need answers from three months or three years ago, organizing this information for posterity allows firms to rely on one source of truth.

Firms can also distill complex, structured datasets into visualized dashboards, which elevate actionable insights by incorporating relevant analytics in charts, graphs, and tables. When screening a new deal, for example, analysts can surface comparables to see if a deal is worth underwriting. Associates can reference underwriting assumptions from similar, passed deals to validate submarket biases. Deal team leaders pitching to the IC can pull up historical performance on a new opportunity.

With easy access to insights, teams of any size can underwrite more deals, surface comparables faster, and make better decisions at scale.

3. Compliance-Friendly Deal Execution Workflows

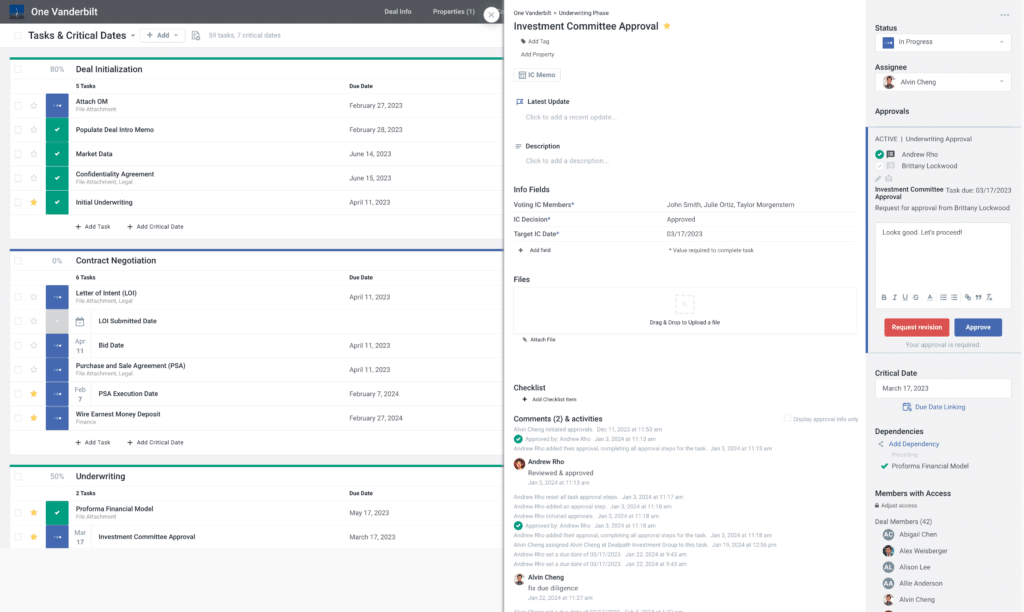

Fast-changing regulations are pressuring investors to become more agile, all while internal investment requirements grow increasingly scrupulous. Relying on spreadsheets and email chains to track these regulations leads to inefficiencies and risk. From the Corporate Transparency Act, to Interest Deductibility Limits, to SEC Climate Disclosure Rules, reconciling every execution checklist with fast-changing regulatory landscapes can take a toll on already-thin team bandwidth.

Firms have transitioned away from old-school systems of record to automated tools in an effort to mitigate risk and manage and track approvals. Digital deal workflow automation helps firms complete every required step–from go-hard dates, to LOIs, due diligence and more. As deals progress, managers and executives can review an audit trail, or dig into which deals have upcoming or remaining tasks.

Dealpath’s suite of execution tools embeds every task in the deal lifecycle, from strategic decisions in deal screening through compliance considerations in closing, alongside deal information.

Automated role-based workflow execution ensures that teams complete every due diligence step efficiently, mitigating the risk of missed deposits. Beyond minimizing risk and offering clarity, systematized deal workflows–including approval processes–also streamline execution and reduce the time to close. When a new regulation surfaces, editing execution workflows is simple and easily scalable.

Without the lingering threat of missed execution, teams can minimize time spent on manual follow-ups–like email reminders and spreadsheet upkeep–to prioritize execution.

4. Higher LP Standards for Performance and Reporting

LPs expect more data-driven precision, transparency, and returns than ever. Investors want real-time access to deal performance, capital deployment, and portfolio updates—not static reports compiled weeks after the fact.

Beyond deal decisions, intuitive reporting tools are now table stakes for showcasing performance to strengthen relationships and win more capital. Granular insights into how recent acquisitions, development projects or loans are performing will not only offer a data-first lens into your portfolio, but also validate your tech-forward approach.

Many executives already use Dealpath to showcase impressive outcomes when they review past performance or raise new funds. Start by deep diving into the financials of one deal, or look at the more holistic picture.

Real-time dashboards highlighting your portfolio’s AUM, property count, occupancy, IRR, and more help investors grasp how your portfolio stacks up against the market. Fund overviews highlighting the average asking price, cap rate, and other metrics can also help investors better understand deals coming down the pike.

Viewing assets by strategy, region and property type can paint a broader picture of your success, too, helping you grow partnerships and win more capital.

5. Building an AI-Ready Data Strategy

Capturing standardized data in a proprietary database won’t just drive decisions today–it also lays the foundations for tomorrow. At Dealpath, we’re seeing firms double down on their data strategies to prepare for the age of AI.

Today, AI is already driving operational efficiencies from sourcing and underwriting to asset management and reporting for firms of all sizes:

- Summarizing market reports and legal documents

- Flagging potential risks in agreements and contracts

- Automating underwriting model analysis

- Investment memo generation

The future is here, but make no mistake–new innovations will continue to emerge, and the firms that fail to adopt them risk falling behind.

We expect to see automation continue to eliminate manual work, helping teams shift their attention to strategic work. Standardized data structures that are common amongst other industry players, third parties and business intelligence tools–a critical prerequisite for capitalizing on these new possibilities–are preparing firms to interface with larger datasets at a rapid pace.

As data standardization continues and AI tools unlock new possibilities with a critical mass of data in one central hub, firms will be able to glean even deeper, predictive insights, make conversational queries, and more. It may also help firms view recommendations about managing deal flow, like which deals to prioritize, based on KPIs.

But to seize these opportunities, firms must first be prepared. Dealpath’s standardized data platform will enable firms to leverage new and emerging tools, even in other systems, with a strong foundation of reliable data.

Seizing Opportunity in the Evolving Acquisitions Landscape

The future of real estate investing is here, and those who embrace the industry’s transformation will be positioned to reach new heights. With a future-ready data platform underpinning every decision and collaborative workflows driving execution, teams will be able to make smarter decisions at a faster and more scalable pace.

Learn how acquisitions teams rely on Dealpath to supercharge their investment strategies here. To learn why 300+ firms choose Dealpath to power their acquisitions investment strategies, request a demo.

Request Demo