In a rapidly digitizing post-pandemic world, advances in new technologies have spurred a heightened need for data center real estate. From supporting AI’s growing infrastructure to explosive growth in eCommerce, streaming, and communication technologies like 5G, data centers continue to play a pivotal role in enabling entertainment, technology, and even financial institutions to reach growth targets. One critical problem the industry faces is that current supply and development starts may not meet the market’s demand, painting a bright future for investors.

Read on to learn more about the opportunities in the data center real estate market, including market dynamics, tailwinds, challenges and more.

Understanding the Real Estate Data Center Market

A data center is a facility designed to house and operate servers hosting data and web applications. Precisely controlled HVAC systems regulate the air temperature, among other factors, to maintain optimal conditions, minimize latency and prevent downtime.

Some data centers are owned by cloud companies, also called hyperscalers, such as Google and Amazon. To capitalize on emerging opportunities in the space, investment managers and operators have recently placed an increased focus on data center real estate investment and development opportunities. Tenants typically range from hyperscalers to smaller companies, including companies from industries such as B2B technology, eCommerce, online gaming, and more.

While not a new asset class in the CRE market, data centers have recently caught the attention of institutional investors seeking alternatives to core verticals facing headwinds, such as office.

Why Investors Are Pivoting From Core Real Estate Markets to Data Centers

From niche data center REITs to industry leaders, investors of all sizes are capitalizing on increasing needs across the software, technology and entertainment spaces. Data centers have proven their mettle by offering consistently high returns, similar to utility companies. Consequently, institutional investors have begun competing more aggressively with cloud companies in the quest for space.

According to McKinsey, data center power consumption is expected to increase from 17 gigawatts to 35 by 2030, indicating a steep rise in demand. According to Newmark, demand for data centers is projected to double by 2030.

Blackstone, the world’s largest real estate investor, purchased QTS Realty, a data center operator with over 7m sq ft across the US and Europe, in 2021 for $10B. In the same year, KKR acquired CyrusOne, a data center REIT with approximately 50 data centers in its portfolio, for $15B.

Data Center Real Estate Companies are Riding the Tailwinds of an Increasingly Digitized World

Like the explosion of the industrial vertical, the data center real estate market has boomed in the wake of the pandemic’s increasingly digitized world.

According to JLL, the global colocation market is expected to grow at a 5-year compound annual growth rate of 11.3% from 2021-2026, surpassed by the hyperscaler market’s projected growth rate of 20%. In fact, a recent Bisnow article showed that rent increases in some markets were already as high as 20%. Additionally, Arizton Advisory & Intelligence expects investment volume in the real estate data center market to reach $28B by 2028.

The rise of hybrid working has driven an increase in the need to store, manage and process data in real estate data centers. Companies introduced new software to meet changing needs as workers dispersed to remote locations, away from office infrastructure. Data centers also support the ongoing shift in consumer preferences from cable television to streaming services, which rely on expansive content delivery networks.

Rapid advances in artificial intelligence, which requires facilities to support data storage and computing, have already bolstered demand for data center real estate. This need will only increase, as labs experiment with generative AI and other data-heavy applications.

Advances in other technology verticals have also contributed to the rising demand for data centers, too. For example, 5G networks and increased smartphone usage have spurred the development and expansion of data centers, particularly in urban areas with heavily concentrated populations.

Real Estate Data Center Firms are Struggling to Deliver on Demand

Despite growing demand, the data center market is experiencing some friction when it comes to delivering on high demand.

Some of the most common real estate data center tenants include cloud companies like Microsoft and Google, but these players may actually pose a challenge to landlords. Due to their size, capital access and significant data needs, acquiring or building a data center may be more financially viable for cloud companies than renting space. As the market continues to develop, this trend could complicate an otherwise rosy outlook for institutional investors seeking large or NNN tenants.

Challenges in Developing Data Center Real Estate

Like many other real estate verticals, the data center market is facing new construction delays due to supply chain challenges. While landlords and owners are struggling to meet high demand, preleasing has accelerated significantly. All the while, rising labor, construction material and other costs have increased capital expenditures.

For some data center development firms, finding power sources compatible with the required semiconductors can be challenging, particularly due to shortages of required materials, such as neon. Additionally, utility companies have struggled to accurately predict the amount of power required to operate data centers. Northern Virginia, the largest data center market in the world, fought power shortages to maintain sufficient energy for new and existing facilities. Some data center developers are also grappling with the challenge of facilitating sufficient cooling, while balancing these needs with ESG requirements.

According to JLL’s 2024 data center report, limited power availability has amplified supply constraints, increased demand and, consequently, driven pre-leasing activity.

Data center development has also suffered from a lack of skilled professionals equipped with the knowledge and experience to lead these projects. 53% of data center providers faced challenges in hiring in 2022, compared to 38% in 2018.

Breaking Down The 5 Types of Data Center Real Estate

Data centers are designed to meet varying needs based on the company’s data and hardware needs, as well as other factors, such as cooling challenges. The five main types of data centers include:

- Colocation: Sometimes called a “carrier hotel”, colocation facilities typically rent hardware and servers to smaller companies

- Managed data centers: Beyond renting servers, managed data centers also offer related services such as data storage, computing and more

- Enterprise: Enterprise data center facilities are owned and operated by companies to process and store their proprietary data

- Cloud/Hyperscale: Large facilities designed to store data for technology and cloud companies, such as Google and Amazon, which may house customer data through third-party hosting services

- Edge data centers: Smaller facilities that are strategically located near end-users to deliver optimal services with minimal latency

Real Estate Investors Are Acting Fast on New Infrastructure Opportunities

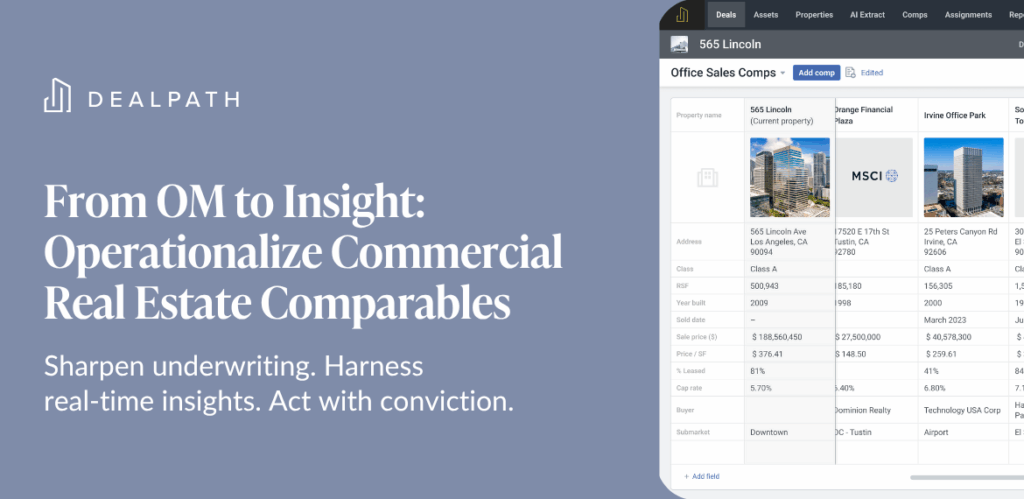

As market dynamics have shifted and capital costs have increased, data center real estate investors have turned to purpose-built real estate investment software to source, manage and execute deals with greater speed, transparency and precision.

By centralizing their pipelines in deal management software, data center deal teams can more nimbly respond to opportunities, without affording competitors a chance to gain an edge.

17 CRE Investment Questions Your Data Can (Finally) Answer Expedite and Add Visibility to Your Industrial Real Estate Investing Process

To outperform the competition and move at digital speed, real estate investment managers must make decisions that are grounded in–not simply supported by–data. Download this guide to learn just a few examples of how CRE investment managers can turn data into answers with unprecedented speed, precision and scale with deal management software.

DOWNLOAD Now