This blog post was last updated on Wedensday, August 23rd.

Before you can prioritize the most work on your plate, you need to know which deals require your attention. However, without the right information, prioritizing can become a task in and of itself.

Dealpath’s custom notifications feature allows you to easily stay up-to-date on every new deal, update and task that matters–potentially eliminating meetings while reducing manual communication. Read on to learn how your firm can automate communications and boost team-wide transparency with custom notifications in Dealpath.

Custom Notifications: A Smarter Way to Notify Team Members of Deal Progression

Staying abreast of real-time deal updates is the only way to tackle high-priority deals at the earliest opportunity or inform your work based on deal progress. Now, you can receive actionable updates on critical deals directly from your inbox.

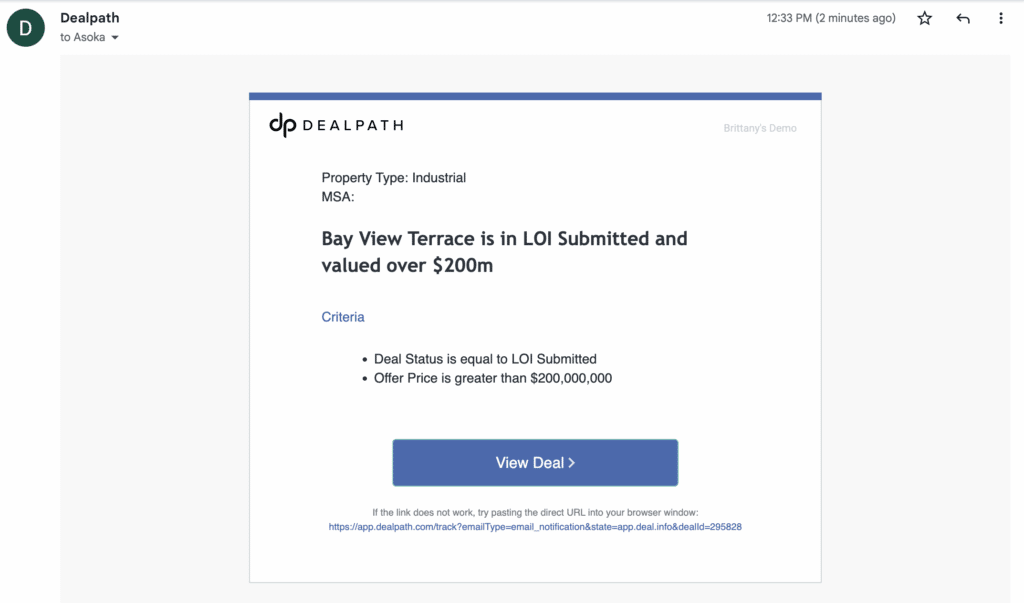

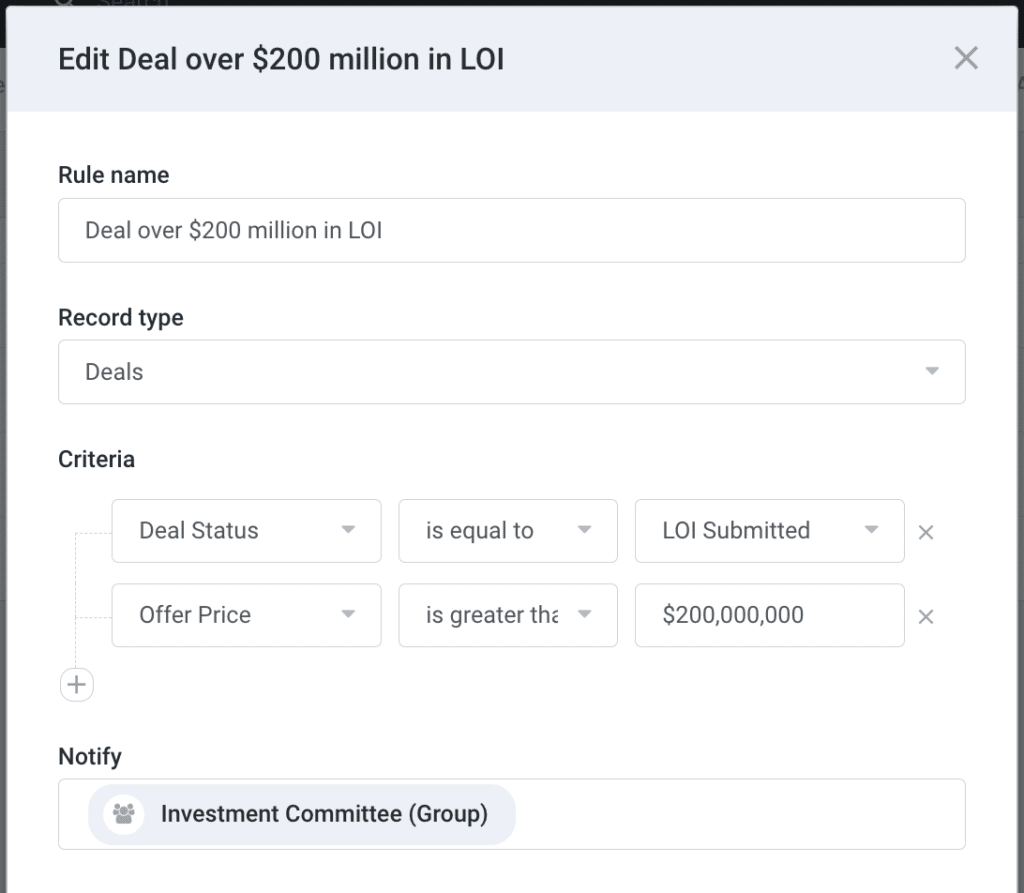

Custom notifications in Dealpath will alert you of important progress on deals that matter to you based on defined criteria. Whenever a deal reaches a certain stage or meets other criteria, you’ll receive an email notification.

5 Ways You Can Skip Meetings and Eliminate Emails With Custom Notifications

Automating deal notifications further reduces manual communication and meeting cadences, bringing even greater efficiencies to your team. Instead of emailing, or even commenting, you can simply push deals through workflows based on your pipeline processes, with confidence that the alert will reach the right team member.

1. Alert Team Members When It’s Time to Start Working Deals

As an acquisitions associate, for example, you may not need to see live updates for every file uploaded during underwriting. You would, however, want to know when underwriting is complete and the deal is ready for a more thorough evaluation. Similarly, the VP of Acquisitions may want to know precisely when an associate has finished writing the IC memo.

Now, team members can opt to receive push notifications as these milestones are completed, avoiding manual communication and unnecessary delays.

2. Surface New Opportunities Matching Certain Criteria to Stakeholders

Beyond milestone alerts, custom notifications also enable stakeholders within your firm to stay up-to-date on certain types of deals. For example, a Chief Investment Officer may only want early-stage updates on deals in highly competitive verticals, like industrial. Custom notifications ensure that stakeholders are aware of any new opportunities they might consider noteworthy.

Or, an Investment Committee member might want to know if a deal of a certain size reaches the LOI stage. Additionally, fund managers are naturally eager to see which deals are allocated to their funds.

3. Notify Stakeholders When Critical Dates Are 30 Days Away

As certain critical dates approach, stakeholders will want to ensure that execution is on track. Receiving an alert 30 days prior to, for example, the construction start date, offers enough time to check in on the deal or project status, reallocate resources to meet deadlines, and simply stay apprised of progress.

Now, deal teams can receive these updates in real time, preventing the need for protracted project update meetings–and accelerating responses to real–time changes.

4. The Closing Date (or Another Critical Date) Changes

Similarly, changes in critical dates could indicate a priority shift for both team members and stakeholders. For example, a change in the closing date on one particular deal might cause certain deal team members to shift their focus to another deal. To remain aligned, deal team members may need to communicate that update to third parties.

In other cases, critical date change notifications might inform a stakeholder that the closing is off schedule, thereby changing a recently updated capital deployment forecast. Consequently, stakeholders would receive these updates without waiting for a pipeline update.

5. Instantly Know When a Deal Closes

Finally, receiving a custom notification of a deal closing can streamline multiple communication channels for deal teams.

First, accounting teams can make changes to reconcile their systems based on the closing, like updating their ERP with new building information. Deal team leaders can celebrate their successes, while turning their attention to the next highest priority. Once the transaction closes, senior management can provide capital deployment updates to investors. Senior management can also provide updates to investors about capital deployment and closed transactions.

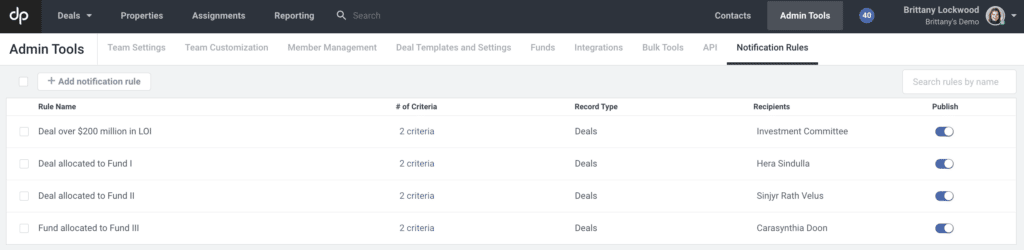

How It Works: Configure Rules Based on Deal Stage & Other Custom Fields

Custom notifications can be configured via rules based on the deal type, deal status or any other field you may want to track. The subject line and email content can be customized to help stakeholders instantly view updates on critical deals directly from their inboxes.

Learn More About Custom Notifications

If your firm is already managing its pipeline on Dealpath, please reach out to your customer success manager to learn more about configuring this new feature.

To learn more about custom notifications and other ways your deal team can build efficiencies in Dealpath, request a demo.