The quality, breadth and depth of your data, as well as how you manage it, directly impacts your investment deal team’s performance. It’s no longer efficient to rely on data stored in spreadsheets or manually search for comps. Instead, a real estate database can help you source critical commercial real estate data for more comprehensive deal screenings and evaluations. In this article, we’ll discuss the role of a commercial real estate database, and explore the top eight solutions available in the market today.

Why Real Estate Databases Are Critical for CRE Institutional Investors

Commercial real estate databases offer deeper, better structured market intelligence that might not be readily available through other channels. They often feature sophisticated analytical tools that allow you to understand data in new and intriguing ways. Tapping into this data guides your investment strategy to help you identify profitable opportunities.

With a commercial real estate database, you’re in a stronger position to detect market patterns, pinpoint trends and work efficiently. In short, commercial real estate databases allow you to screen deals faster and more strategically, ultimately propelling your business forward.

What to Look For In A Commercial Real Estate Database

At the most basic level, a commercial real estate database needs to be able to source critical industry information firms use to guide investment decisions. Data must not only be accurate, but also reflect real time changes. Your team can’t spend their limited time manually inputting or updating information.

Analytical tools within real estate investment software are also critical, as they allow teams to draw conclusions that fuel an investment strategy. Being able to seamlessly recall past deals or related comps will greatly speed up the analytical process and allow you to make comparisons with ease. Furthermore, the ability to filter down for a more granular view of relevant data relevant to your current objectives is vital.

Your commercial real estate database also needs to integrate with other tools to facilitate seamless communication and visibility. Centralization is a must, as it allows you to review multiple different datasets against the opportunity you’re considering.

Top 8 Commercial Real Estate Databases

Dealpath

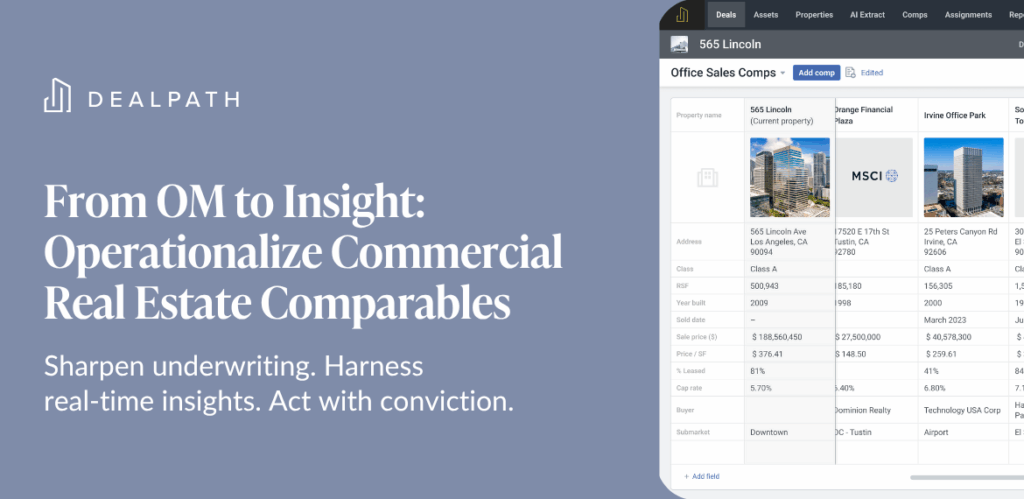

How effectively your team digests and derives intelligence from commercial real estate data impacts everything, from the deals you pursue to your portfolio’s growth. Strong data alone won’t suffice; you need analytical tools to guide your investment decisions.

While not a data product, Dealpath is a powerful deal management software that enables teams to source, standardize, and leverage commercial real estate data for deeper insights. Through intuitive filter-based analytics, you can instantly recall past comps and deals, screening new pipeline opportunities in minutes. Real-time reporting ensures that you can keep a minute-to-minute pulse on your pipeline and uncover the most profitable opportunities. Leveraging Dealpath, Dermody Properties grew its portfolio of assets under management by 400% by building operational efficiencies.

Altus Group

The best commercial real estate research tools provide a window into historical deals for your target markets. These insights can guide day-to-day investment decisions, while also expanding on your understanding of wider market and investment trends.

Altus Group is one of the leading real estate data companies for the Canadian market. Composed of Altus Data Studio plus Reonomy, this platform gives investors access to real-time and historical transaction data, comps, alongside monitoring tools for local markets. These data products are a great asset for investors looking to back their moves with reliable third-party data.

CoStar

CoStar is a leading commercial real estate database covering a wide range of property sectors. As the market leader in the U.S., CoStar’s robust platform includes extensive comps and transactional data. CoStar also offers a range of other commercial real estate data and information products that can augment each aspect of their real estate business.

CompStak

The more comps you can look to for context, the better you can vet real estate deals in your pipeline.

CompStak takes a crowdfunding approach to building a commercial real estate database by collecting comps straight from the professionals working at leading commercial brokerages and appraisal firms. Their crowd-sourced model is unique in that it requires you to give comps in order to access comps. This standardized, rigorously vetted data then becomes available to other investors researching their target markets.

CompStak is integrated with Dealpath, so Dealpath users can seamlessly log into Compstak to review comps alongside pipeline deals.

Real Capital Analytics

Much of the commercial real estate data investors use concentrates on ongoing deals, historical information, and market analytics. Real Capital Analytics delivers on these critical fronts, but also offers vital market information about investors, key players and transactions.

Real Capital Analytics is a commercial real estate database that allows you to dive deep into market transactions as well as the individual investors behind deals. Users can discover property owners, attributes, debt terms, and more.

Esri

Financial data is at the heart of every real estate transaction, but it’s hardly the only information that should inform your investment strategy. Population and area demographics add invaluable context when vetting your investment thesis.

Esri is a mapping and analytics platform providing data for a variety of different industries, including government, transportation, and more. Real estate investors can harness these insights to enrich their analysis and capture additional details that financial data might miss.

Cherre

All too often, compiling data from multiple systems of record can quickly become inefficient and limit the insights available. Today’s investors need a way to bring data from across their business–including investment, asset and portfolio data– into one place for more holistic decision making.

Cherre is not a traditional commercial real estate database. Instead of providing property and market information, this platform aggregates different data sources into a single platform. As a result, decision makers across the organization can analyze data through a more holistic lens to measure performance and strategize. This is an effective way to close the feedback loop for siloed functions within your business.

Preqin

There are times when you need to go beyond the essentials to truly pinpoint a promising investment deal. By reviewing current and future commitments on a property, as well as funding plans, you’ll be able to draw deeper insights than with just standardized commercial property data alone.

Preqin is used by professionals operating in a wide range of industries for commercial real estate data, future investment plans, fund searches, as well as individual and institutional investor profiles. Armed with additional datasets, your firm can dig even deeper into commercial real estate deals.

Systematize Data-Driven Decisions With Commercial Real Estate Databases

Capitalizing on the latent value of your commercial real estate database calls for modern tools. Download this e-book to learn how a deal management software can empower your data-driven decision making and propel your business forward.

Download Now