This blog post was last updated on Wednesday, July 16th.

Data is the new currency of commercial real estate. But, a comparable is only as valuable as your team’s ability to put it to work for pricing, underwriting, and decision making. In a market where pricing is opaque and timing is everything, a fragmented CRE comps process slows decision making and exposes your strategy to unnecessary risk.

Winning investment teams don’t just collect sale comp records—they combine proprietary data with verified market comps to build a trusted, centralized database that turns scattered information into a strategic asset.

Housing all of this information in a single source of truth sharpens underwriting, aligns teams, and empowers all professionals to act with greater conviction. Read on to see how leading firms modernize their comps strategy in Dealpath—and gain a complete, actionable view of the market to fuel decision making.

A Centralized, Structured Comps Database Is Now Table Stakes in Real Estate

All too often, real estate sale and lease comps collect dust where they started—buried in email threads, spreadsheets, OMs, and scattered drives. When comp data is trapped in these silos, teams face unnecessary friction in managing investment workflows and decisions.

Static, disjointed data makes it hard to validate assumptions, compare deals consistently, and price with conviction. Ultimately, teams face inefficiencies that erode speed, accuracy, and confidence.

In a data-first market with billions at stake, firms can’t afford to make decisions on disparate or stale data. That’s why leading teams are uniting proprietary comparable data and market intelligence in one searchable, purpose-built database structured based on investment criteria.

Collecting comps is easy, but centralized databases are raising the bar for how firms act on these insights, particularly as AI tools present new opportunities to put this data to work.

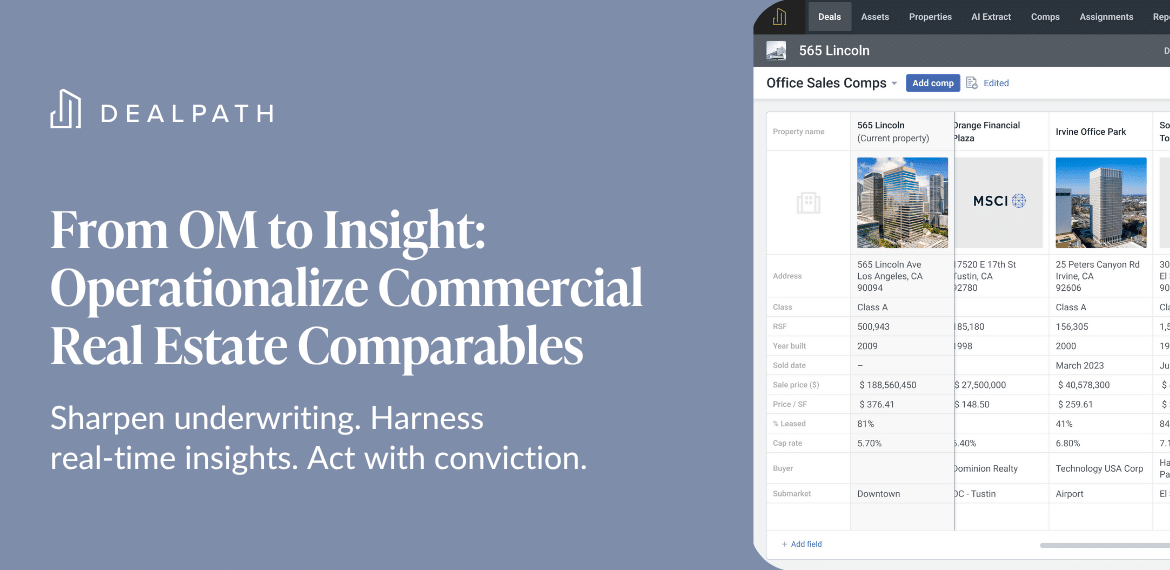

Automatically Build a Proprietary Comparables Database From Real Estate OMs

Real estate teams already interact with commercial property comparables in OMs, PDF attachments, and email threads that cross their desks every day. The problem isn’t getting the data, but structuring it to make it actionable and future-ready.

Dealpath helps institutional investment teams build proprietary comps databases from deals they already touch:

- AI Extract automatically parses key deal data from offering memorandums, helping teams populate deal files faster—and convert passed or evaluated deals into data-rich comps

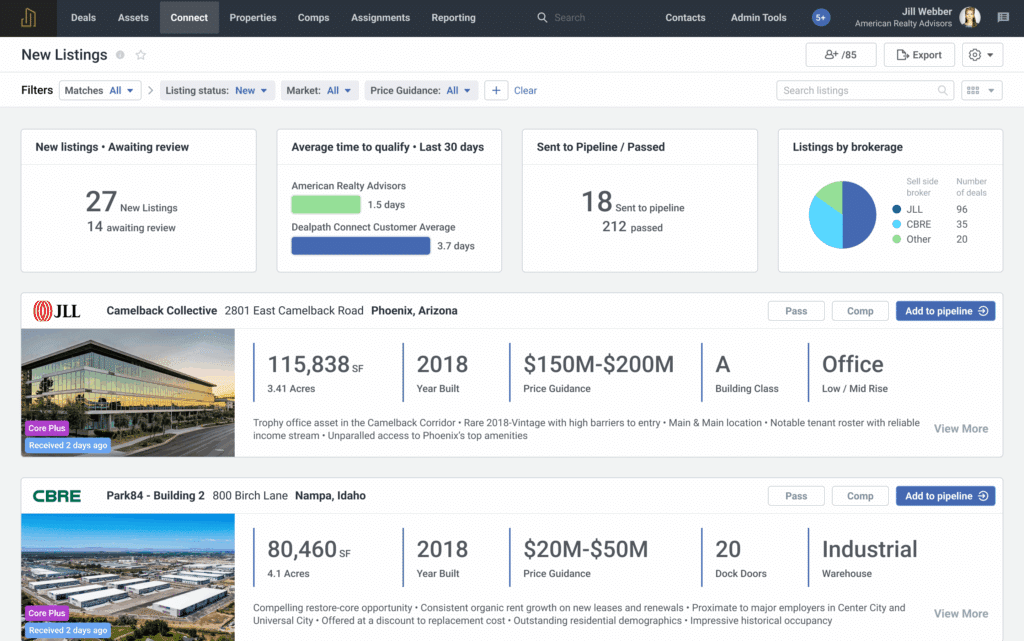

- Dealpath Connect brings broker listings directly into your pipeline, allowing teams to turn live opportunities into structured comps that can be saved and leveraged over time

With Dealpath, firms are capturing 4X more real estate comps in a centralized database.

By capturing the information you already see and surfacing it in a standardized format, a centralized database makes your proprietary data not only searchable—but actionable.

Bring Verified Third-Party Comps Into the Same System

Many firms already subscribe to premium comps data providers—but that value often lives in disconnected tools and formats that sit outside your core deal workflow. Without integrating that data into your centralized comps database, it’s difficult to compare deals in context, benchmark assumptions, or move quickly when opportunities arise.

To get full value from paid comps sources, leading firms are injecting this market intelligence—like sales comparables or leasing data—into their centralized database alongside proprietary comps. This allows teams to:

- Aggregate more comps by enriching proprietary records with market-validated benchmarks

- Align third-party comps to your data structure and investment strategy

- Review internal and external comps side-by-side, without jumping between tools

Bringing third-party comps into your system of record doesn’t just consolidate data—it puts that data to work for faster, more informed, and more defensible investment decisions.

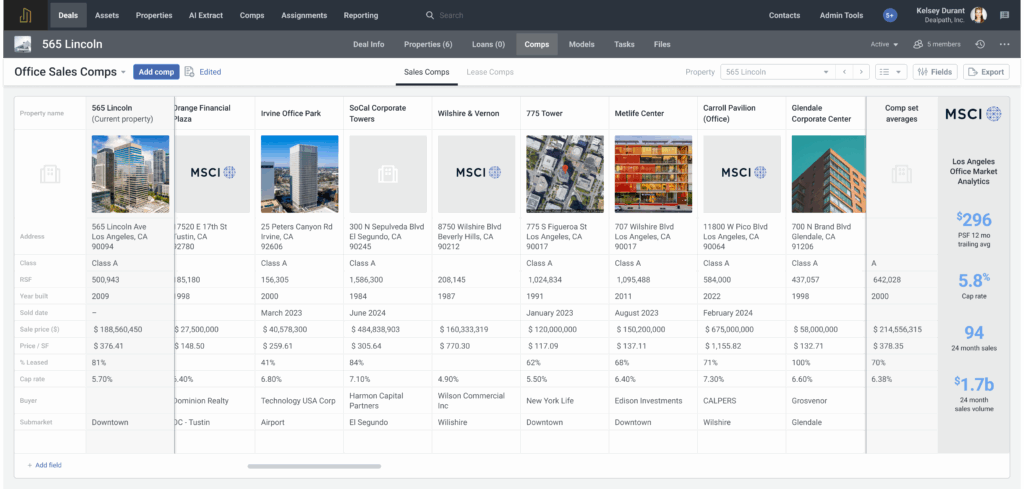

For example, Dealpath’s integration with MSCI Real Capital Analytics (RCA) allows investment teams to access the industry’s most comprehensive database of verified commercial property sales. By surfacing relevant sales comp benchmarks based on deal criteria like property type, market, and asset type, teams can benchmark pricing assumptions against real, market-tested transactions. This unified view strengthens underwriting confidence, accelerates deal workflows, and brings clarity to investment committee discussions—all without leaving your deal management platform.

Compare New Deals Against Proprietary Comps and Market Data in Real Time

Comps are only valuable when they’re actionable. Whether sourced from past deals, broker listings, or paid data providers, the true power of comps lies in being able to tap into them at the exact moment you’re evaluating a new opportunity.

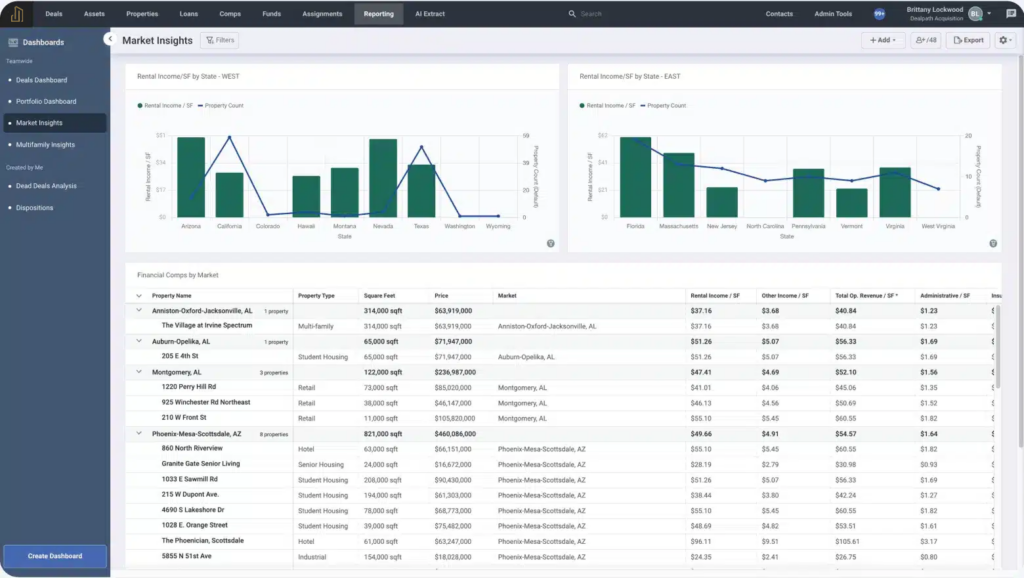

Dealpath makes it easy to surface relevant comps—both proprietary and third-party—based on criteria like location, property type, and asset class. Teams can quickly filter and compare attributes like price/SF, cap rate, square footage, and lease terms without ever leaving the deal file.

By pulling these comps into a side-by-side view, Dealpath enables teams to quickly assess whether a new deal is in line with market benchmarks, compare underwriting assumptions against verified transactions, and defend their thesis in investment committee conversations. Whether validating cap rate assumptions for a multifamily acquisition or supporting a bid strategy for a competitive industrial deal, comps are instantly available where and when teams need them most.

The result? Faster, more data-backed pricing decisions that align teams around a single source of truth.

What Data Should Be Included in Commercial Real Estate Comps?

To draw meaningful insights from comps, you need more than numbers—you need structured context. Comps typically include data like:

- Sale price and price/SF

- Sale date

- Cap rate

- Property type and subtype

- Location and market

- Buyer and seller

- Square footage or units

- Year built

- Lease terms (for lease comps)

Dealpath enables teams to log, filter, and compare this data consistently across all deals, creating a comprehensive record of market activity, institutional knowledge, and deal performance over time.

What Are Offering Memorandums (OMs)?

An offering memorandum—commonly referred to as an OM—is a marketing document shared by brokers to provide potential buyers with key information about a commercial property. It typically includes details like sale price, cap rate, tenant mix, lease terms, and market comps.

These documents are often the first place a real estate team encounters valuable deal data—including what can later become comparables, or “comps.” A comp is a previous deal used as a benchmark to evaluate new opportunities.

Dealpath’s AI Extract feature pulls relevant data from OMs automatically, enabling teams to create deals and build comps without manual entry. Combined with Dealpath Connect—which brings in structured data from broker listings—this shift turns OMs from static marketing PDFs into a dynamic fuel source for a searchable, growing comps database.

Centralizing Data: The Foundation for AI, Reporting & Strategic Advantage

Every comp you capture lays another brick in a foundation that supports AI-driven insights, better reporting, and smarter long-term strategy. When your comp database is standardized and housed in the same system as your pipeline, underwriting models, and approvals, your team gains:

- More accurate and consistent underwriting assumptions and pricing comparisons

- Consistent data sets across underwriting and IC materials

- A future-ready database to drive AI-powered analysis and insights

In Dealpath, comps live alongside the rest of your deal data, enabling better reporting, smarter forecasting, and a more agile investment process.

Unlock the Full Power of Comps With a Centralized Data Platform

The next generation of CRE performance won’t just be about seeing deals first—it will be defined by how effectively teams can analyze those deals using trusted, centralized data.

Dealpath helps leading firms harness their proprietary and third-party data to build a comps strategy that fuels smarter, faster investment decisions.

- Capture and structure comps directly from OMs and broker feeds

- Benchmark new deals against real-time internal and market data

- Enable pricing and IC alignment across the team

Request a demo now to power your comps strategy with a platform built for real estate.

Request Demo