What’s a Qualified Opportunity Zone? Understanding Tax Advantages

Institutional investors follow varying strategies based on their goals, risk tolerance and market expertise, with the ultimate goal of driving the highest risk-adjusted returns. In recent years, qualified opportunity zones have emerged as a way for investors to grow their portfolios while aiding in the development of communities. In this article, we’ll explain what a […]

Task Management in Dealpath: 5 Simple Tactics to Execute At Scale

Closing a higher volume of deals is key to growing your portfolio and outperforming competitors, but doing so is challenging. How can you effectively scale when every deal requires a significant time commitment across your team? Ultimately, building operational efficiencies is a vital step toward achieving the speed and scale that all teams strive for. […]

Top 8 Commercial Real Estate Databases & Data Sources [Investors]

The quality, breadth and depth of your data, as well as how you manage it, directly impacts your investment deal team’s performance. It’s no longer efficient to rely on data stored in spreadsheets or manually search for comps. Instead, a real estate database can help you source critical commercial real estate data for more comprehensive […]

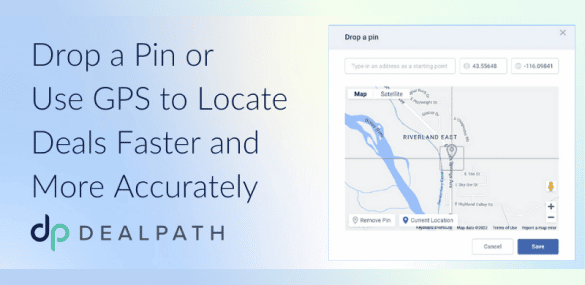

Drop a Pin To Locate a New Deal or Property in Dealpath

When your firm receives information about an opportunity without a readily available address, adding it to your pipeline might require guesswork. Did you know that you can simply drop a pin to locate a new deal or property’s coordinates in Dealpath–even when raw land lacks a registered address? In this blog post, we’ll review how […]

CRE Tech: 9 Essential Solutions for a Digital Transformation

In today’s fast-paced market, the most lucrative opportunities go to the firms that can identify, vet and execute on them the fastest. Often, that means the firm with the best CRE tech stack will beat the competition. According to Foursquare’s study, 60% of commercial real estate professionals have difficulty making decisions and keeping pace with […]

5 Operational Inefficiencies That Slow Deal Flow & How to Solve Them

To grow top-line revenue and deliver investor returns, investment management teams must review every deal relevant to their goals in a data-driven, and ideally, efficient manner. But with numerous deal screening, underwriting and due diligence processes to follow, it’s not uncommon for deals to lose momentum as teams juggle priorities. Building efficiencies to manage ongoing […]

How to Calculate the Internal Rate of Return on Commercial Properties

From cap rates to yield on cost, CRE investment managers measure their pipelines and portfolios with numerous metrics. None, however, offer more direct insight into a deal’s profitability than the internal rate of return. The internal rate of return is a metric that investors rely on to understand the rate at which an investment’s value […]

Connor Mortland Fireside Chat: Doubling Deals Reviewed & Under Contract

Across debt and equity groups, enterprise and lean investment firms, and all markets, deal management software has proven its mettle in the real estate world as a driving force behind top-line revenue growth. With real-time pipeline visibility and standardized workflows, firms can make faster, more efficient data-driven decisions. One such firm is Avanath Capital Management, […]

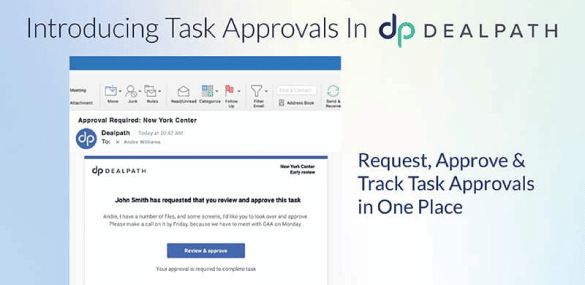

Introducing Task Approvals: Request, Approve & Track Tasks in Dealpath

Real estate deal teams are tasked with managing sophisticated workflows throughout the deal lifecycle, including numerous approvals from various stakeholders. With Dealpath’s new Task Approvals feature, teams can now request, approve and track tasks, all in one place. Read on to learn more about how managing Task Approvals directly in Dealpath empowers deal teams to […]

Building a Baseline in Dealpath: 7 Metrics that Matter

Portfolio growth is one of the clearest signals of success for commercial real estate investment managers, but it’s far from the only metric that you can look to for performance insights. You can’t manage what you can’t measure, which means firms that are reliant on generic project management tools and Excel for pipeline tracking often […]