How to Build a Commercial Real Estate Comps Database With OMs [Guide]

This blog post was last updated on Wednesday, September 13th. Investor intuition and market knowledge are invaluable as your firm evaluates deals, but data must be the bedrock of multi-million dollar investment decisions. Every real estate offering memorandum (OM) you review can add value to your investment decision-making–and more broadly, your institutional data advantage– in […]

What is Net Operating Income in Real Estate: NOI Formula & More

This blog post was last updated on Wednesday, September 6th. Thoughtful investment decisions call for thorough, diligent screenings to ensure that the deal pencils out. Naturally, the profit a property or portfolio generates is top of mind for institutional investors evaluating deals. Among others like IRR and cap rates, one of the most critical metrics […]

5 Ways to Eliminate Emails and Skip Meetings With Custom Notifications

This blog post was last updated on Wedensday, August 23rd. Before you can prioritize the most work on your plate, you need to know which deals require your attention. However, without the right information, prioritizing can become a task in and of itself. Dealpath’s custom notifications feature allows you to easily stay up-to-date on every […]

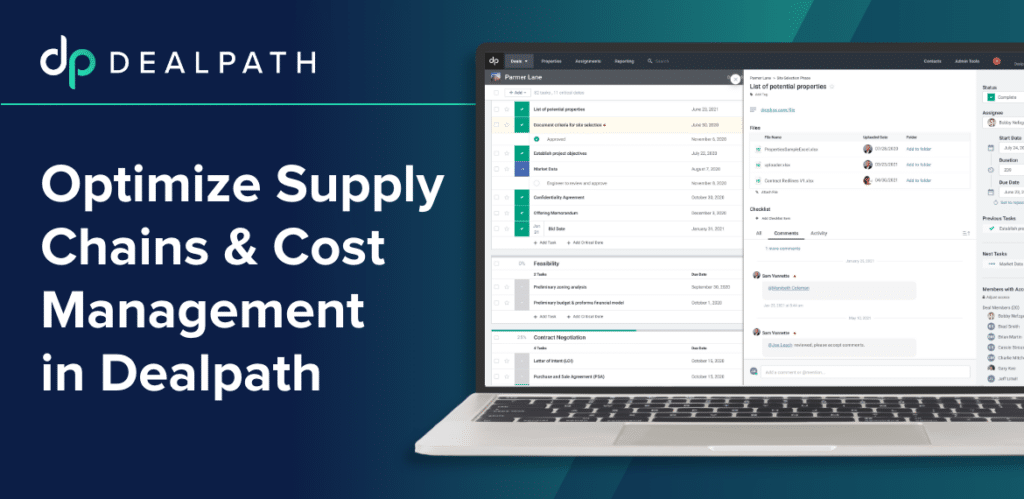

3 Tips to Conquer CRE Development Supply Chain Challenges in Dealpath

Commercial property insurance costs have increased by 10% year-over-year, while experts anticipate high borrowing costs could cause a construction slowdown, even as the Fed continues rate hikes. All the while, developers continue to navigate real estate supply chain bottlenecks and rampant inflation, stalling project deliveries and profitability. While these challenges are here to stay, there […]

What Is Yield on Cost in Real Estate Development?

This blog post was last updated on Wednesday, July 19th. Yield on cost is one of several metrics that investors and developers consider when evaluating deals to verify the risk is worth the reward. Also known as the development yield, this metric helps deal teams to precisely measure risk and track return profiles through the […]

From Implementation to ROI: Dealpath Customer Success Webinar Recap

Your data-driven real estate investment strategy is only as strong as the technology supporting it. Choosing a deal management solution provider is more than picking software off the shelf–it’s a strategic, long-term business decision that directly impacts your firm’s ability to harvest intelligence and build efficiencies. Back in June, the Dealpath team hosted a webinar […]

The Definitive Real Estate Due Diligence Checklist (And How to Digitize It)

This blog post was last updated on Wednesday, July 5th. Before finalizing a new acquisition, development, disposition or lending deal, investors thoroughly vet the deal during due diligence to ensure it aligns with their ideal risk-return profile and identify red flags. Exhaustively investigating the property, financials, zoning, and nearly all other investment criteria creates much-needed […]

The 4 Types of Commercial Real Estate Investment Strategies [Guide]

Institutional investors share the common goal of generating revenue by building a portfolio with compounding value, but different investors accomplish this in various ways. Depending on risk tolerance, fund specifications and expertise, there are several types of real estate investment, as well as real estate investment strategies, that investment managers can employ. Each strategy presents […]

3 Reasons to Reevaluate Your CRE Debt Origination Process

Siloed data and information often complicates the debt origination process, leaving teams to navigate challenging workflows fraught with friction and, ultimately, delaying closings. As the real estate industry undergoes a digital transformation with proptech, though, new deal management software has empowered firms to accelerate deal turnaround times and gain a competitive advantage. Rising capital costs […]

From Excel Jockey to Dealmaker: Prioritizing Strategy and Negotiation

Balancing repetitive weekly tasks with urgent, ad-hoc requests from leadership leaves real estate deal teams with minimal time to tackle strategic priorities. At the end of the day, the most important thing is that your pipeline is on track and leadership, whether that means the VP of Acquisitions or Managing Director, can see deals are […]