2024 brought seismic shifts to an already rapidly evolving commercial real estate market landscape. With interest rates beginning to normalize, market activity increasing, and firms mobilizing their data strategies to win in the age of AI, leading players sought new ways to adapt and seize opportunity. Throughout the year, our industry-leading team released numerous features to empower the world’s most sophisticated firms to capture more data, surface stronger insights and execute on their investment strategies more efficiently.

In this blog post, we’ll review the most transformative new releases shaping our clients’ success in 2024 and laying a strong foundation for 2025.

Looking Back on Innovations and New Releases in 2024

In 2024, we doubled down on our mission to guide real estate’s most sophisticated firms through a changing market by delivering new solutions to help them systematize data-driven decision making and streamline business operations. Guided by feedback from hundreds of institutional firms—including Blackstone, Nuveen, LaSalle, CBRE Investment Management, and MetLife—we helped customers to unlock an unprecedented new sourcing channel, tap into deeper data and insights, and streamline collaboration.

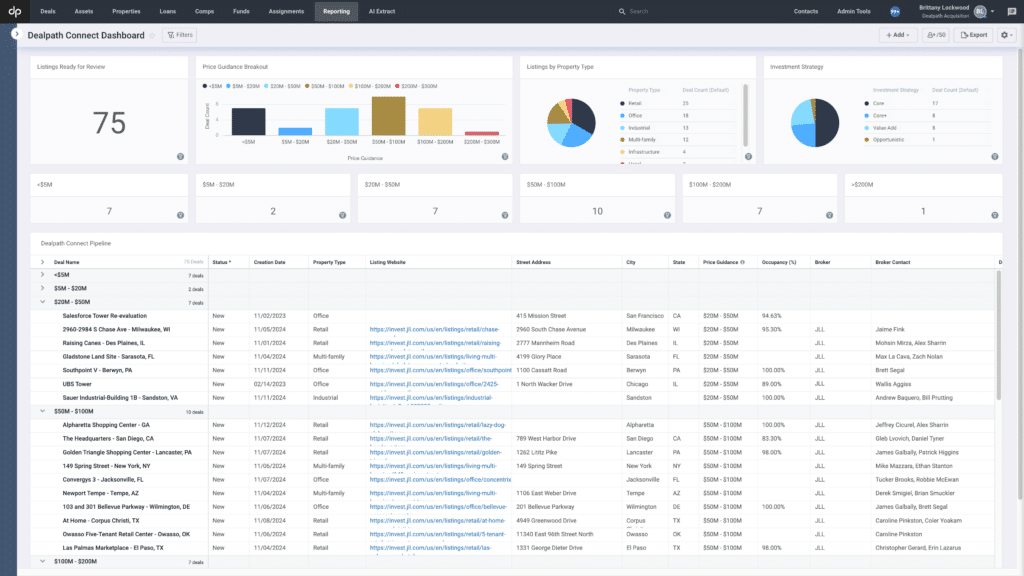

Dealpath Connect: The Future of Real Estate Dealmaking

In November, we announced Dealpath Connect, a first-of-its-kind data network connecting investment opportunities with institutional buyers through Dealpath’s industry-leading platform. Dealpath Connect marks a massive leap forward for the CRE industry by ensuring investors review every relevant deal, while also helping firms seamlessly capture market data and execute on the best opportunities, while accelerating deals and maximizing deal visibility for brokers.

Dealpath Connect launched in beta with JLL and LaSalle Investment Management, with numerous additional partners being added.

To request a demo and learn how your firm can access exclusive market opportunities by connecting its pipeline to leading brokerages, click here.

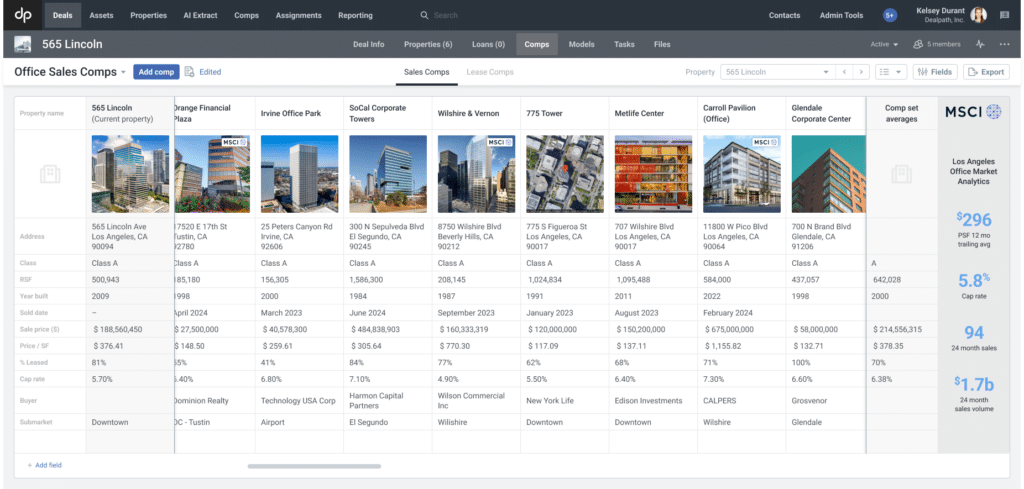

MSCI RCA Integration: Instantly Surface Market Insights

In an increasingly digitized market where the firms with the best information win, a forward-thinking data strategy is now table stakes. We announced a partnership with MSCI’s Real Capital Analytics (RCA) solution, which enables clients to tap into RCA data directly within Dealpath to surface market insights and streamline deal screening, underwriting and diligence processes for a competitive edge in any market cycle.

Over the course of 2025 and beyond, we will continue helping firms leverage comps to unearth deeper insights and strengthen data-driven decision making.

Learn more about using Dealpath as a proprietary deal database for real-time decisions.

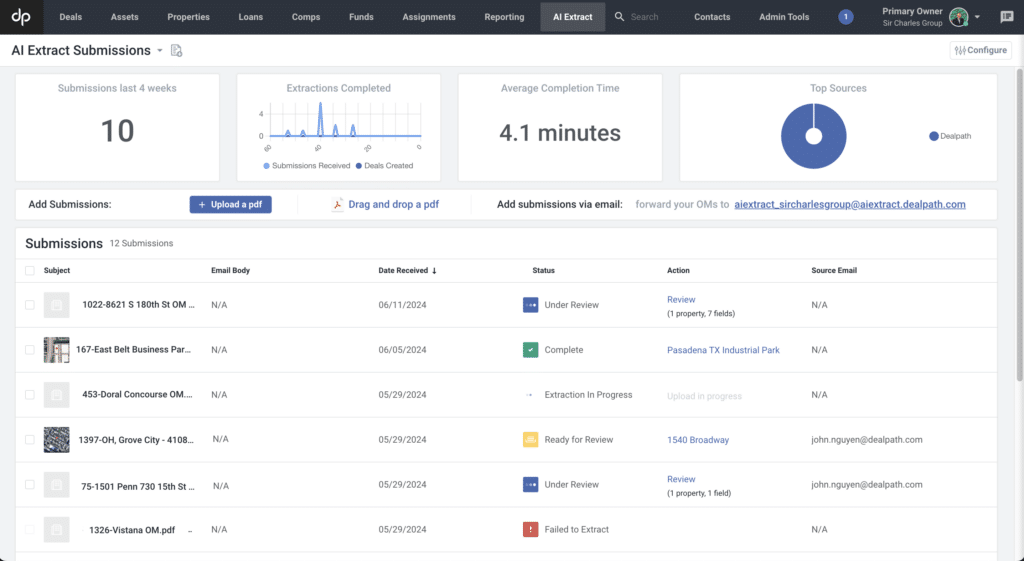

AI Extract: AI-Powered Data Capture for a Competitive Advantage

When data underpins every decision, and volumes of that data are trapped inside PDFs, teams sink hours of time into manual data entry or it dies in your inbox. Dealpath’s AI Extract solution handles the heavy lifting of capturing data from every OM or broker listing that crosses your desk, instantly standardizing and organizing critical deal data. This AI-powered automation empowers firms to evaluate more deals, build a proprietary database of comparables and identify high-potential opportunities faster.

Learn more about how to capture every deal and property that crosses your desk with AI Extract. Firms using AI Extract saw a significant increase in market comps captured in a searchable proprietary database.

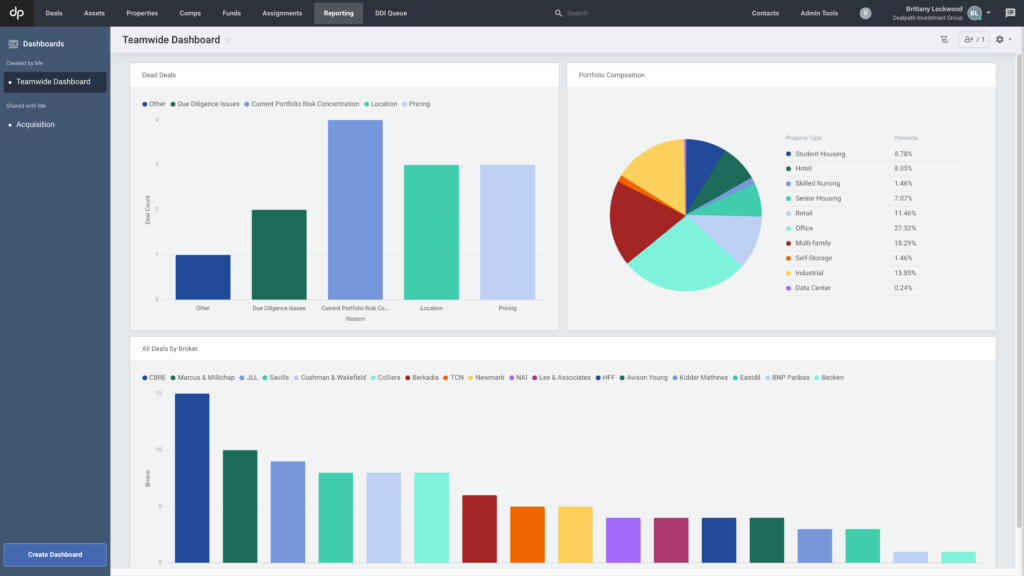

Dashboards & Data Visualization: Turn Data into Insight

No matter how much data you capture, a centralized database that translates that information into meaningful insights is key to realizing your competitive advantage. Earlier this year, we launched enhanced Dashboard Reporting, delivering new visualizations to drive better investment decision making. This enhancement builds on our already robust reporting tools, which were the most advanced in the industry. By customizing dashboards, firms can turn data into the answers they need for screening, underwriting, and diligence—or even offer instant insights to executives.

Learn about the top 8 dashboards for data-driven real estate investors here. Firms relying on Dealpath’s dashboard reporting tools have created over 20 automated recurring reports with real-time information.

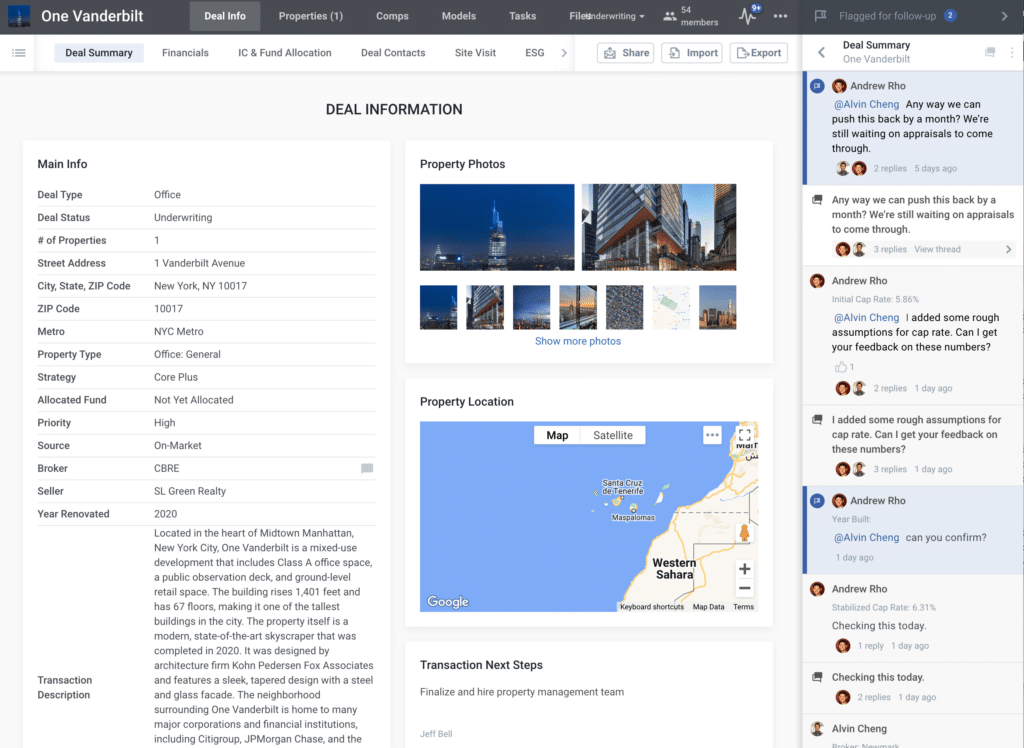

Conversations: Streamlined Collaboration for Confident Execution

Siloed collaboration across email, meetings, chats, spreadsheets, and other channels can cause friction that creates deal or regulatory risk. We launched a new Conversations feature to bring valuable deal discussion directly into Dealpath, enabling investment professionals to make decisions in the context of deal data and information. Embedding discussion in one source of truth removes the risk of missed updates, while creating an audit trail that memorializes decision making throughout the investment lifecycle.

Learn how firms better manage risk and collaborate in real time on Dealpath. Firms relying on Conversations and other collaboration features that systematize deal workflows saw a 30% decrease in errors across underwriting, diligence and deal execution.

Expanding Our Global Footprint & Institutional Client Base

As the real estate deal management category creator, Dealpath continued to expand its global reach throughout 2024, welcoming 50 new clients from across the globe and with various investment strategies, including KingSett, Federal Realty, Town Lane and Stockbridge.

Each client received a bespoke implementation aligned to their unique goals, data and investment strategies. Our post-implementation NPS score was 60.

These new customers continue to partner with our industry-leading Customer Success team to refine their strategies.

Today, over 300 institutional clients trust Dealpath with their real estate investment process. Our enterprise-ready platform, proven implementations, and white-glove customer support equip real estate investment managers worldwide to thrive regardless of market conditions.

We’re proud to support 7 of the top 10 institutional investors globally and to be ranked as the #1 deal management platform for:

- Acquisitions

- Dispositions

- Development

- Loan Origination

Recognition From Industry Experts

While innovating to empower client success remained our top priority in 2024, we were also proud to be recognized by various organizations and publications across the real estate industry, including awards such as:

- 2024 Globe St. Influencers in CRE Tech

- APPEALIE with Software Leadership Award

- Commercial Observer Power PropTech

- New York Real Estate Journal’s Women in CRE

- New York Real Estate Journal’s Innovators in CRE

Looking Ahead to 2025 and Beyond

In a dynamic and fluid real estate market, Dealpath remains committed to leading the transformation of the real estate investment management space. We look forward to even more new features and enhancements in 2025 that will further support our clients’ investment strategies as we empower them to identify the best opportunities, operate at scale and deliver optimal returns.

Harness the Power of Your Data for Better Investment Decisions

Dealpath unites data, insights and deal execution in one purpose-built, future-ready platform to empower real estate investment management firms to close the best deals faster and drive better decisions over time.

To learn how your firm can join the ranks of over 300 firms embracing the future of real estate investing, request a demo.

Request Demo